Introducing Investor Cost Basis On-Chain

We introduce the Cost Basis Distribution (CBD), a novel metric that helps identify key accumulation and distribution zones, tracks their evolution over time, and offers a data-driven framework for understanding critical price levels derived from on-chain data.

At the core of on-chain analytics for market intelligence lies a fundamental concept rooted in “timestamping” and “pricestamping”. The transparent nature of blockchain data allows us to observe every on-chain transaction and identify two key details:

- When the movement of coins occurred – the timestamp.

- At what price the transaction took place – the pricestamp.

This simple yet powerful principle allows us to calculate what is known as the realized price—the cost basis of those coins at the time of the transaction.

As time passes, we can monitor the coins’ unrealized profit or loss based on market price changes. Alternatively, if the same coins are moved again, we can calculate their realized profit or loss based on the difference between their previous cost basis and the price at the time of the new movement.

Throughout the history of on-chain analytics, numerous metrics have been developed to quantify the average cost basis of investors, as well as their unrealized and realized profitability. These metrics provide valuable insights into market behavior and investor sentiment. Some of the most notable include:

- Realized Cap & Realized Price: Metrics that calculate the value of coins based on their most recent on-chain movement rather than the current market price.

- MVRV: A ratio that compares the market capitalization to the realized capitalization, often used as a measure for profitability and to assess overbought or oversold conditions.

- NUPL: Measures the aggregate unrealized profit or loss held by all investors in the market.

- SOPR: Indicates whether coins are being sold at a profit or loss on average.

- Net Realized Profit/Loss: Tracks the net profit and loss that investors realize when moving their coins on-chain.

Introducing the Cost Basis Distribution (CBD)

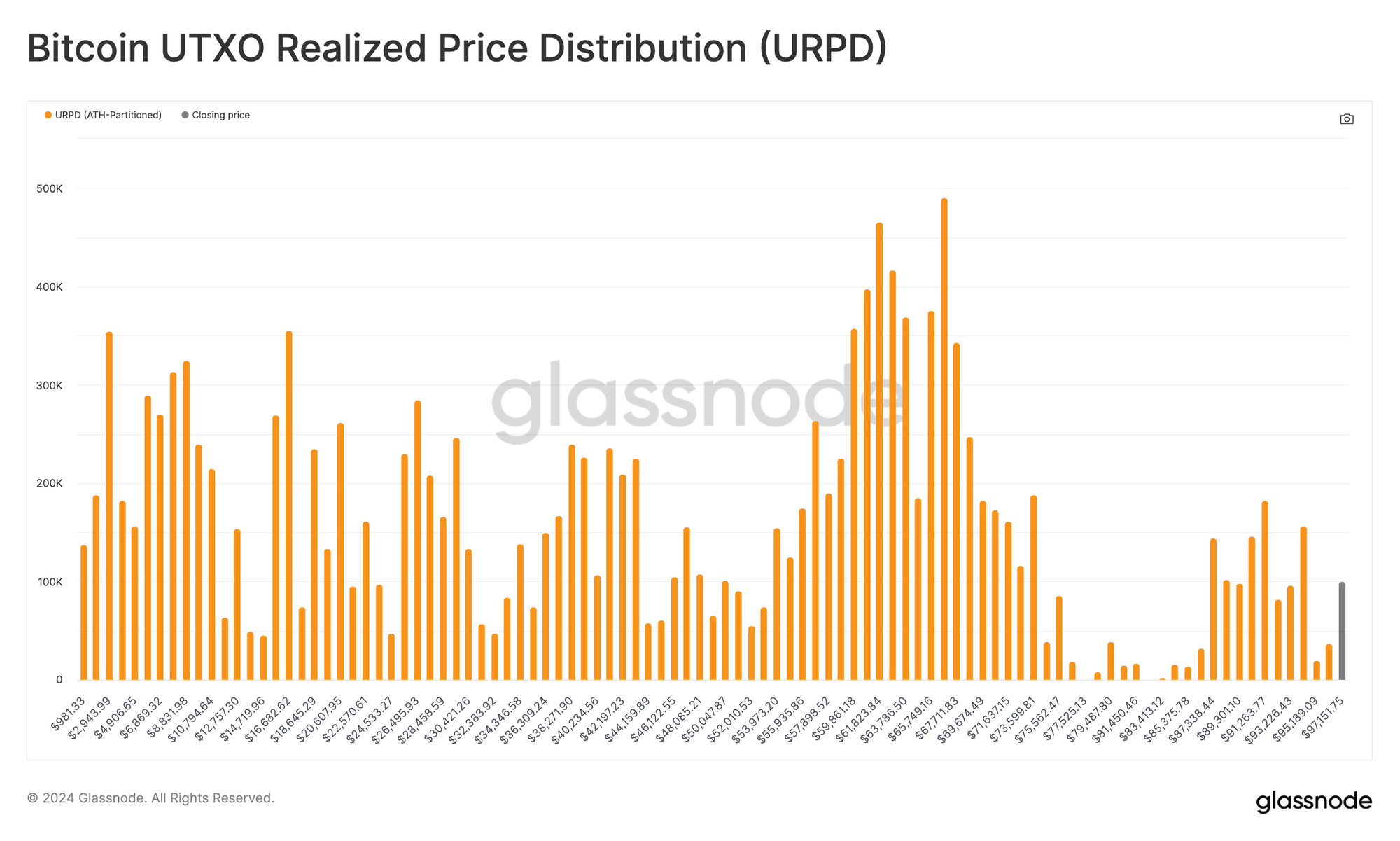

A more granular approach to analyzing Bitcoin’s cost basis is the UTXO Realized Price Distribution (URPD) metric, introduced by our team at Glassnode several years ago. Instead of merely computing the average cost basis across the entire network, URPD splits the supply into price buckets, enabling us to understand how much supply has been accumulated at specific price ranges—essentially mapping the network’s cost basis in detail.

While URPD is highly effective for understanding the current cost basis distribution, it has a notable limitation: it lacks a time component. This makes it difficult to analyze how accumulation zones evolve over time or how investors’ cost bases shift as coins move.

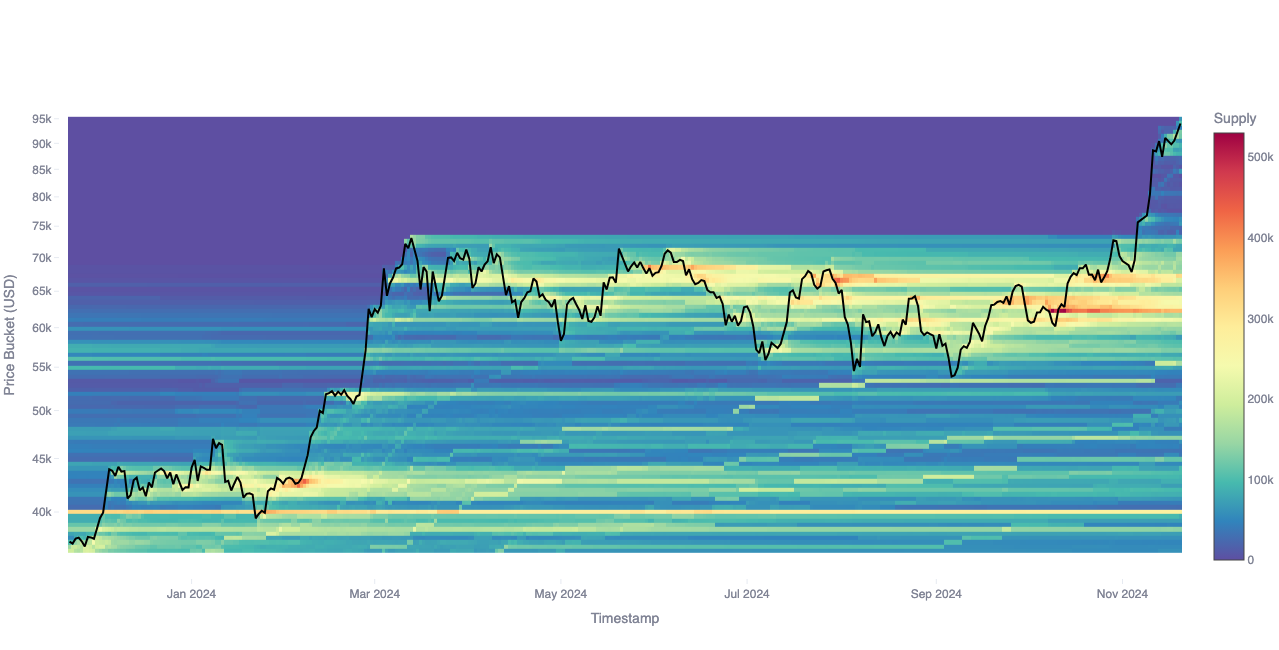

To overcome this limitation, we are introducing the Cost Basis Distribution (CBD), a metric designed to enhance and expand upon the insights provided by URPD. The CBD offers two key improvements:

- Improved visual representation with a time component

- CBD employs a heatmap with fixed price bucket levels (y-axis) for a selected period, enabling clear visualization of trends and shifts in cost basis over time.

- Address-based approach

- Unlike URPD, which analyzes raw UTXOs, CBD calculates data on a per-address basis. This approach brings two significant advantages:

- It provides a more accurate reflection of cost basis, as CBD calculates the average cost basis per address, better representing individual network participants' overall behavior.

- It aligns the methodology with account-based blockchains, making the metric applicable across a wider range of digital assets.

- Unlike URPD, which analyzes raw UTXOs, CBD calculates data on a per-address basis. This approach brings two significant advantages:

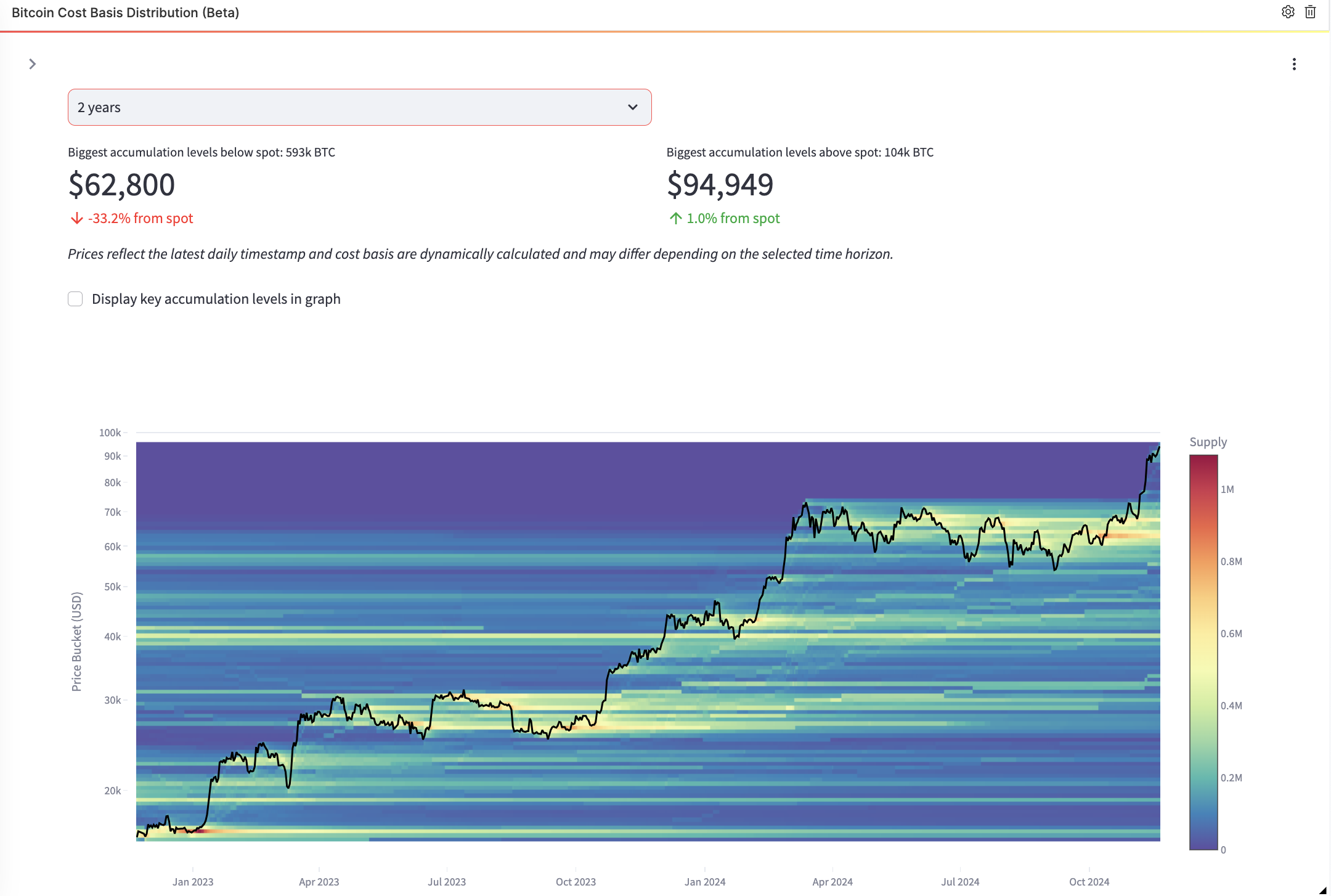

CBD reflects the total Bitcoin supply held by addresses with an average cost basis within specific price buckets, as shown in the heatmap’s z-values (color intensity). Unlike URPD, which tracks supply accumulated at specific price levels, CBD focuses on aggregated cost bases, enabling a clearer view of how investors’ cost bases shift over time due to buying or selling activity.

Key insights

The Cost Basis Distribution (CBD) provides profound insights into Bitcoin’s market dynamics by highlighting key cost basis levels. These zones, representing critical price levels as an aggregate of individual market participants, offer a direct and detailed view of investor behavior.

Unlike traditional technical analysis (TA), which infers support and resistance from price and volume alone, CBD is rooted in blockchain data, identifying actual accumulation patterns. This makes it a powerful complementary tool for validating traditional TA levels.

By enabling the tracking of evolving cost basis patterns, CBD allows investors to observe how supply shifts across price levels over time. It reveals how different price ranges function as accumulation or distribution zones during various market cycles, providing valuable insights into market sentiment and risk. For example:

- Accumulation during corrections can reflect confidence and perceived value among investors.

- Distribution during rallies may signal profit-taking or declining confidence.

These insights empower investors to refine entry and exit strategies using data grounded in real market dynamics. CBD’s granular, time-sensitive view of Bitcoin’s cost basis distribution equips market participants with a robust framework for understanding trends, managing risk, and making informed decisions.

Use cases drawn from CBD

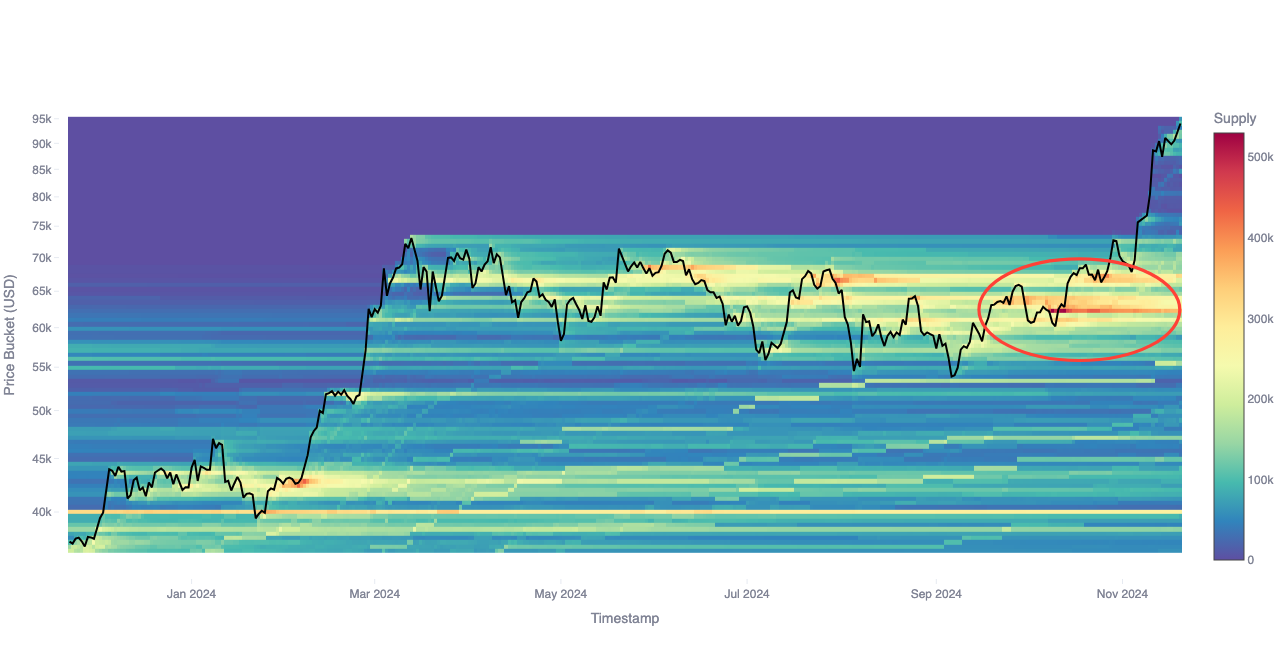

With CBD, it's no longer just about where the cost basis of supply is currently located but how it has shifted, giving a sense of market sentiment. The dynamics of supply offer insights into the price levels at which market participants have gained or lost confidence.

For example, in October 2024, we observed a strong phase of accumulation before the market climbed to $70,000, represented by the hot area on the heatmap below. As the market continued to rise, traders began redistributing their coins, and the supply at this level started fading into lighter orange and yellow shades.

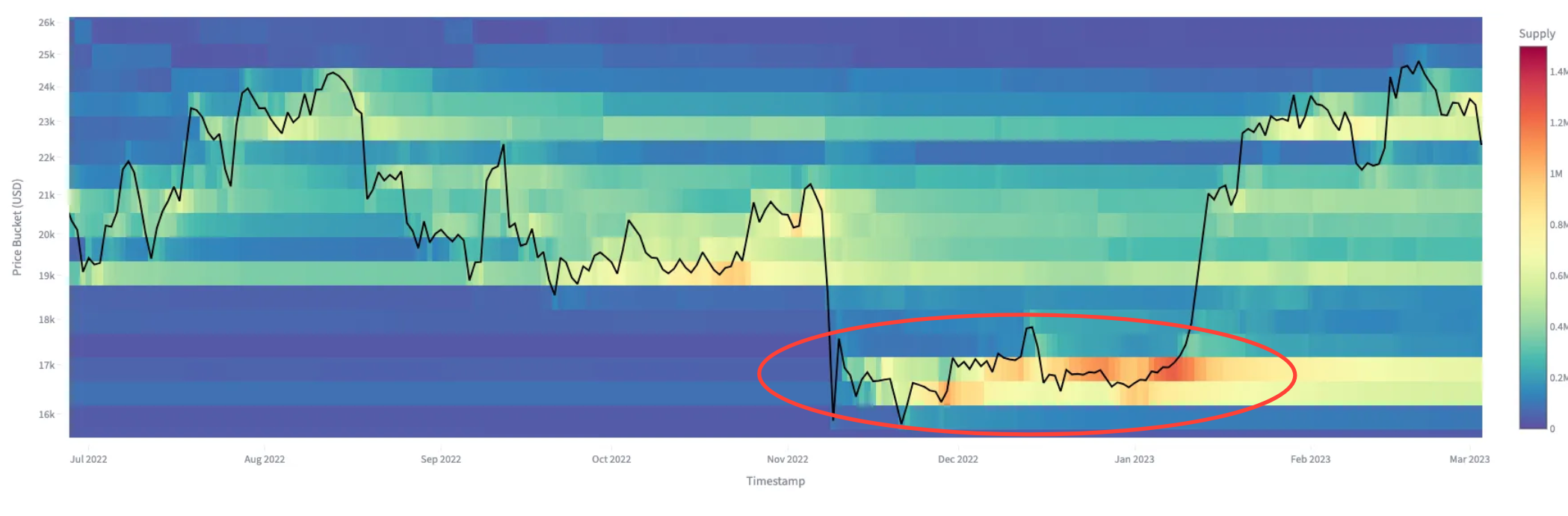

Another example is around the time of the FTX collapse in November 2022. We saw a steady accumulation of supply in the $16,000–$17,000 range, providing a strong floor in a very uncertain market environment. This indicated confidence amongst long-term investors at that price level.

CBD is available as of today, alongside additional derived metrics, on Glassnode Studio.

Other metrics derived from CBD

Building on the dynamic framework of CBD, a range of derivative metrics has been developed to further dissect and analyze supply dynamics with greater precision. These advanced metrics leverage the foundational insights of CBD while introducing new dimensions of understanding:

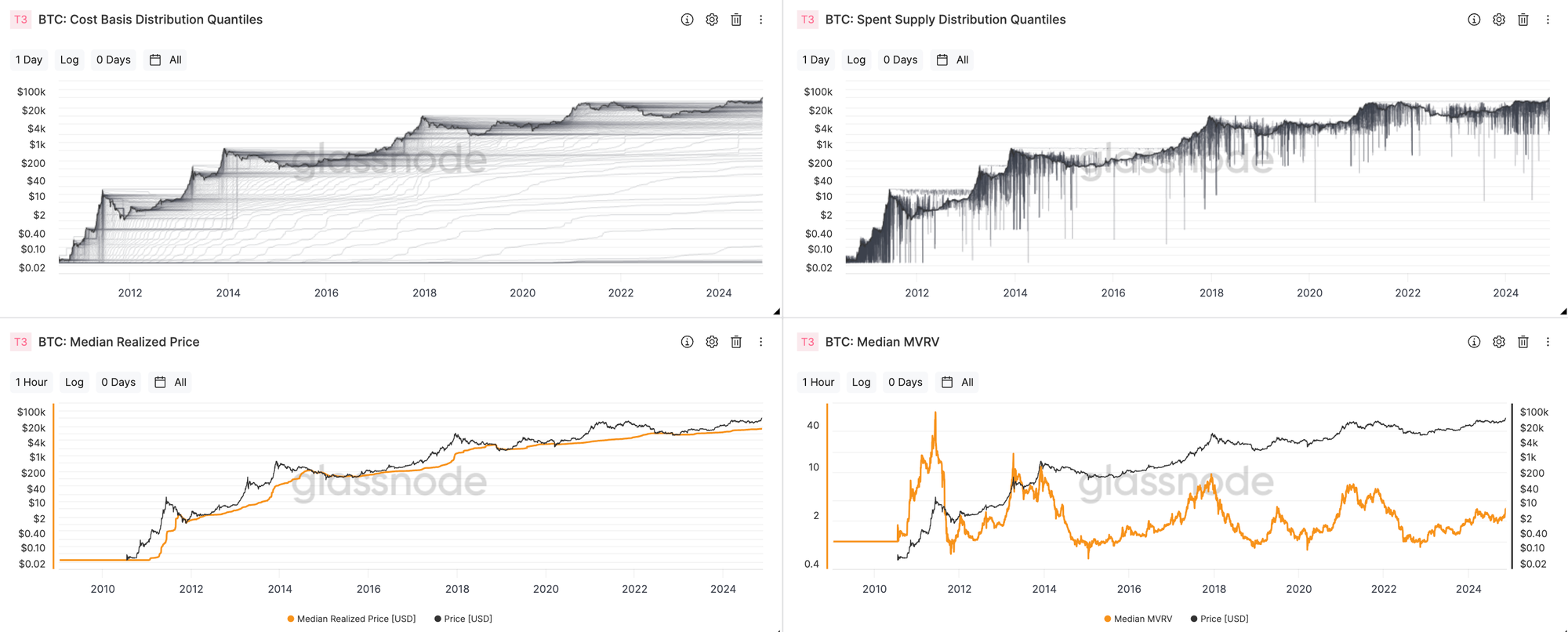

- Spent Supply Distribution Quantiles: By breaking down the cost basis of assets being spent into 100 quantiles, this metric captures detailed selling activity. A surge in this distribution suggests that participants across different price levels are exiting positions. This behavior often aligns with the formation of significant resistance or a temporary price ceiling, reflecting shifts in market dynamics.

- Cost Basis Distribution Quantiles: This metric divides the supply distribution into 100 quantiles (percentiles) based on realized prices. Dense clusters of quantile lines emphasize significant price levels.

- Median Realized Price & MVRV: By comparing the market price to the median realized price, Median MVRV provides insights into Bitcoin's overall valuation relative to a more central acquisition cost. High values suggest the market price is above the typical acquisition level, indicating potential overvaluation, while low values hint at potential undervaluation. Unlike the mean realized price, which can be skewed by outliers, the Median Realized Price represents the price at which half of the supply last moved. This offers a balanced view of acquisition costs across the entire supply.

What's next?

Soon, we’ll expand CBD metrics to all supported assets and introduce API endpoints for heatmap data, enabling seamless integration into trading and risk management systems. CBD represents a significant advancement in on-chain analysis, merging the robustness of traditional technical analysis with the unique insights offered by on-chain data. Whether you're gauging market strength or seeking entry and exit points, CBD and its derivatives provide a powerful, data-driven perspective on supply dynamics.