Tracking Sentiment via Liquidity Pools

Volatility has returned to digital assets markets, with performance of ETH and many tokens experiencing outsized drawdowns. Derivatives markets are suggesting liquidity continues to move higher up the risk curve. We also deep dive into how liquidity pools provide market information.

Executive Summary

- Event driven volatility has re-entered digital assets markets in recent weeks, with notable indicators of aggregate capital outflows flagged leading into it.

- Derivative markets show a continual outflow of liquidity, particularly across ETH futures suggesting capital continues to move higher up the risk curve to relative safety.

- We deep dive into how Uniswap liquidity pools have many similarities to options markets, with Liquidity Providers expressing a view on both volatility, and price levels.

Digital Asset Markets Wake Up

Over recent weeks, digital asset markets have been shaken awake from a period of historically light volatility. This was driven primarily by two key events:

- The flash crash on 17-Aug where BTC and ETH sold off -11% and -13%, respectively.

- News over Greyscale's legal victory over the SEC broke 29-Aug, driving prices briefly higher, however all gained ground was lost over the following three days.

Spot prices for both BTC and ETH are currently languishing around the August lows.

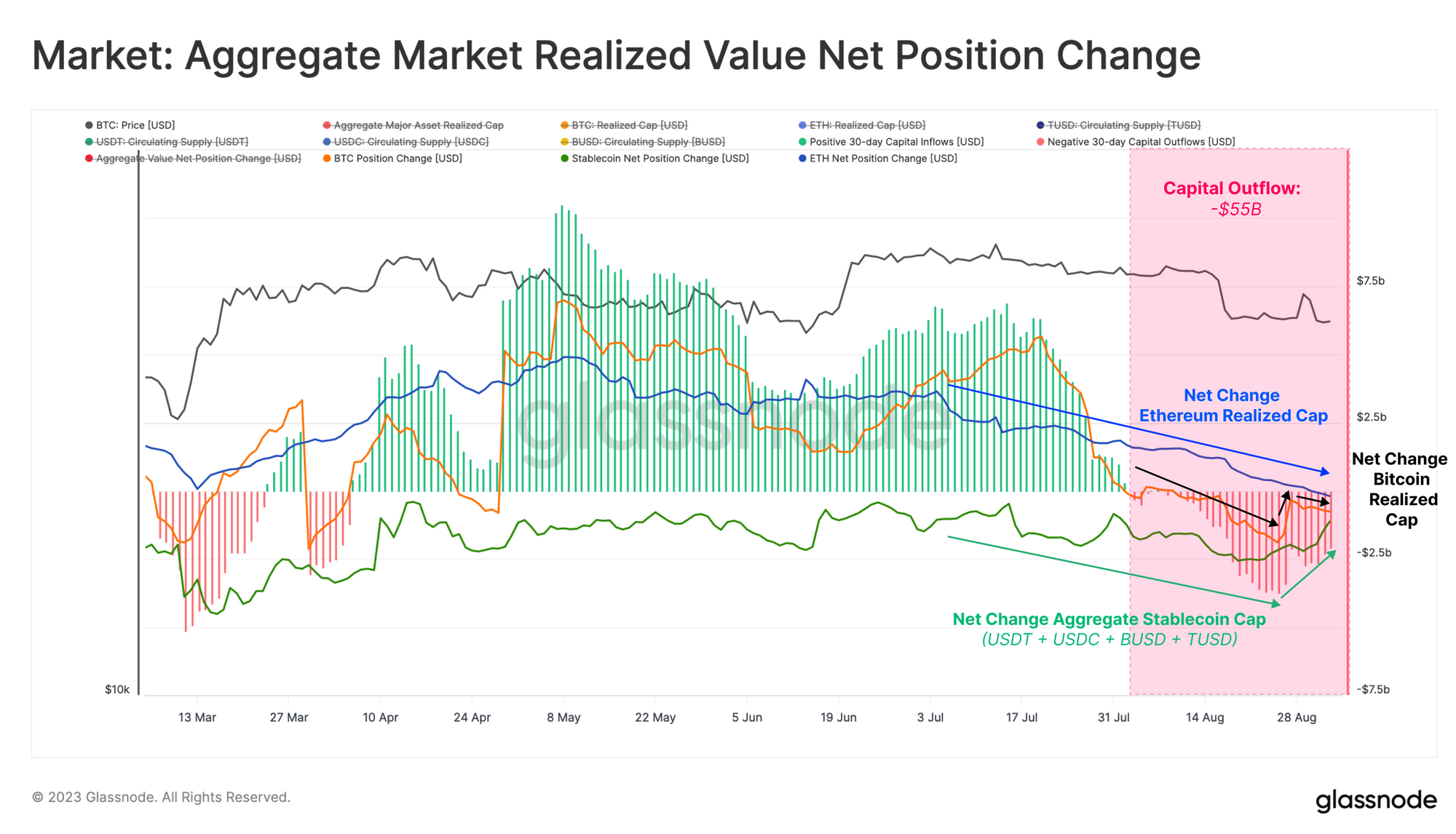

A key metric for tracking aggregate capital flows into the industry is the Aggregate Realized Value metric. This tool combines:

- The realized cap of the two majors BTC and ETH

- The supply of leading five stablecoins USDT, USDC, BUSD, DAI and TUSD.

From this, it becomes clear that the market had entered a regime of capital outflow in early August, well before these two major events. Approximately $55B in capital has left the digital asset space through August.

This trend is driven by capital outflows across all three assets Bitcoin, Etheruem and stablecoins.

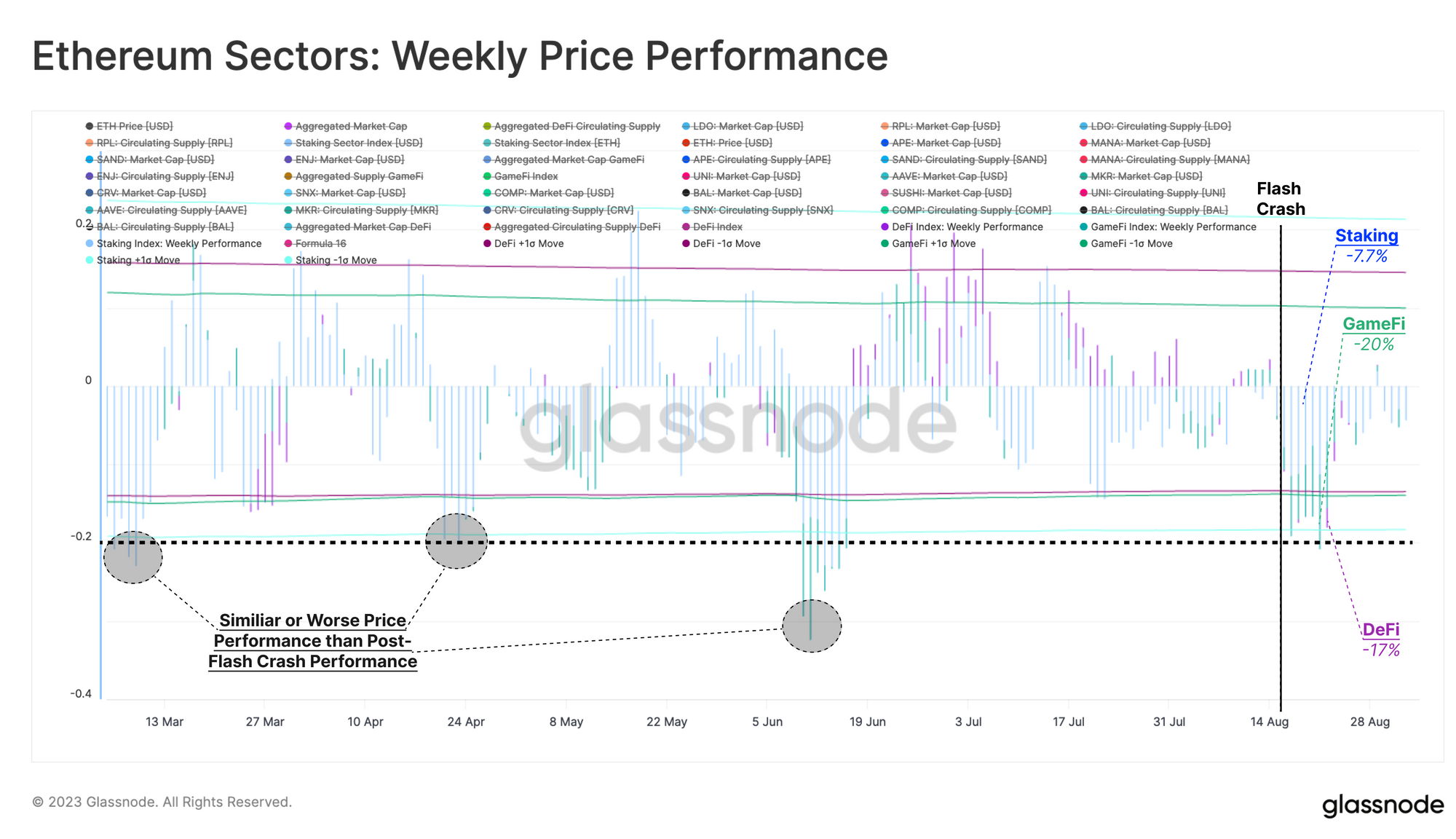

Within the Ethereum ecosystem, there has been a mixed reaction across indices for the DeFi, GameFi, and Staking sectors. Each index is constructed from the average supply-weighted price of 'Blue-Chip' tokens in the sector.

We can see that DeFi and GameFi tokens have performed relatively poorly (-17%) and (-20%) compared to the majors, whilst Liquid Staking tokens were somewhat better off (-7.7%). Across the board however, the downside price action was similiar or less severe than the downturns seen in March, April and June.

Risk Appetite Declines Across Derivatives Markets

One of the key developments over the 2021-23 cycle has been the maturation of derivatives markets, especially for BTC and ETH. The way derivatives markets price these assets can provide information about market sentiment and positioning.

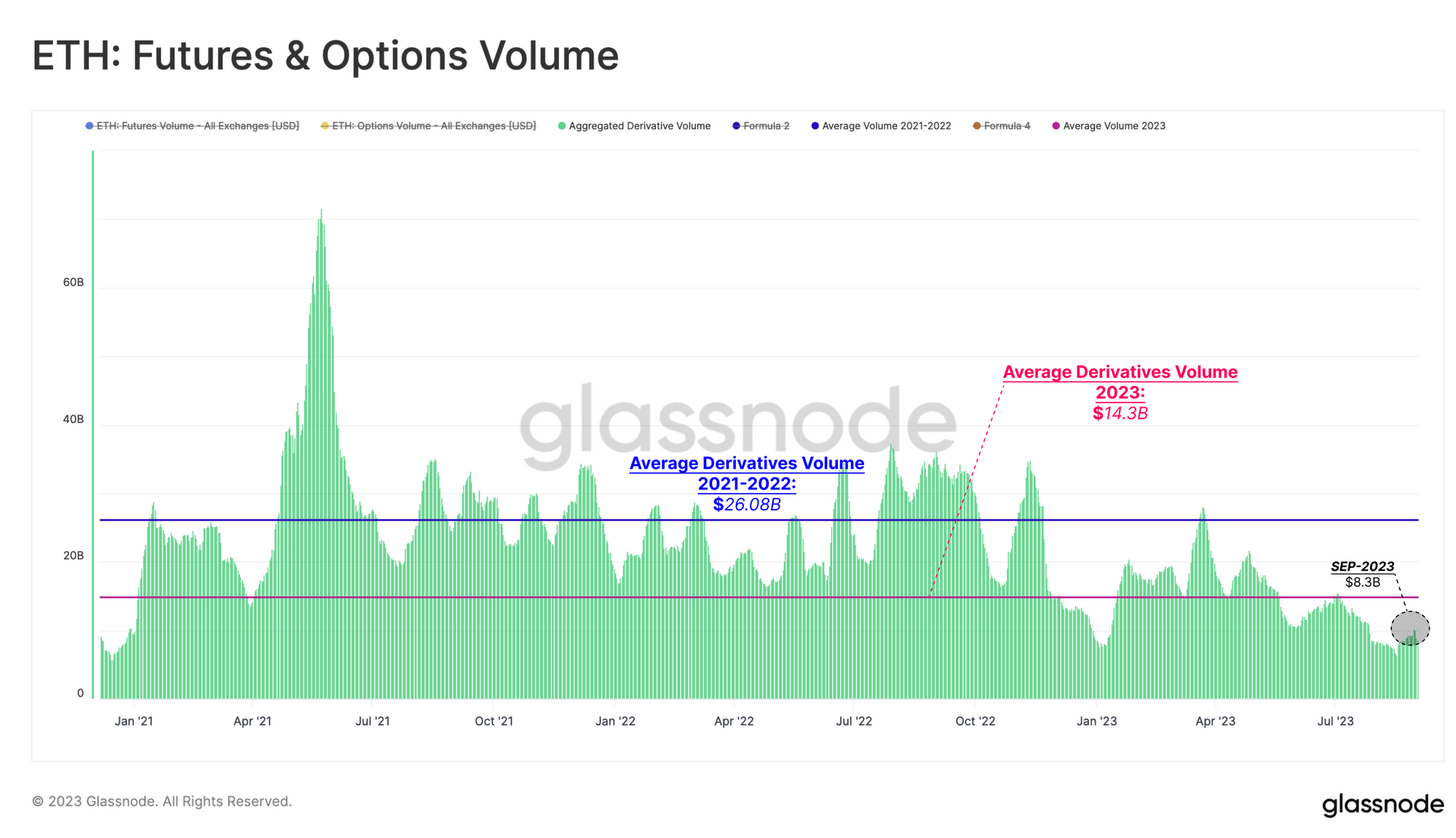

General activity across Ethereum futures and options markets in 2023 is notably below levels seen throughout 2021 and 2022. The average daily trade volume across both markets has declined to just $14.3B/day, which is around half the average volume over the last two years. This week, volume is even lower at $8.3B/day, suggesting liquidity continues to drain from the space.

This trend is mirrored in derivatives Open Interest. Following the market lows set in the wake of the FTX collapse, Open Interest started to climb in early 2023. For Options, open interest peaked during the March banking crisis when USDC experienced a depeg from $1. Ethereum futures open interest peaked around the Shanghai Upgrade, suggesting this was the last major speculative event for the asset.

Since then the notional value of active contracts in both markets has been quite stable. Similar to our observation for BTC markets (WoC 32), ETH options markets are now of a similar scale ($5.3B) to future markets ($4.2B), and are in fact larger in size at present.

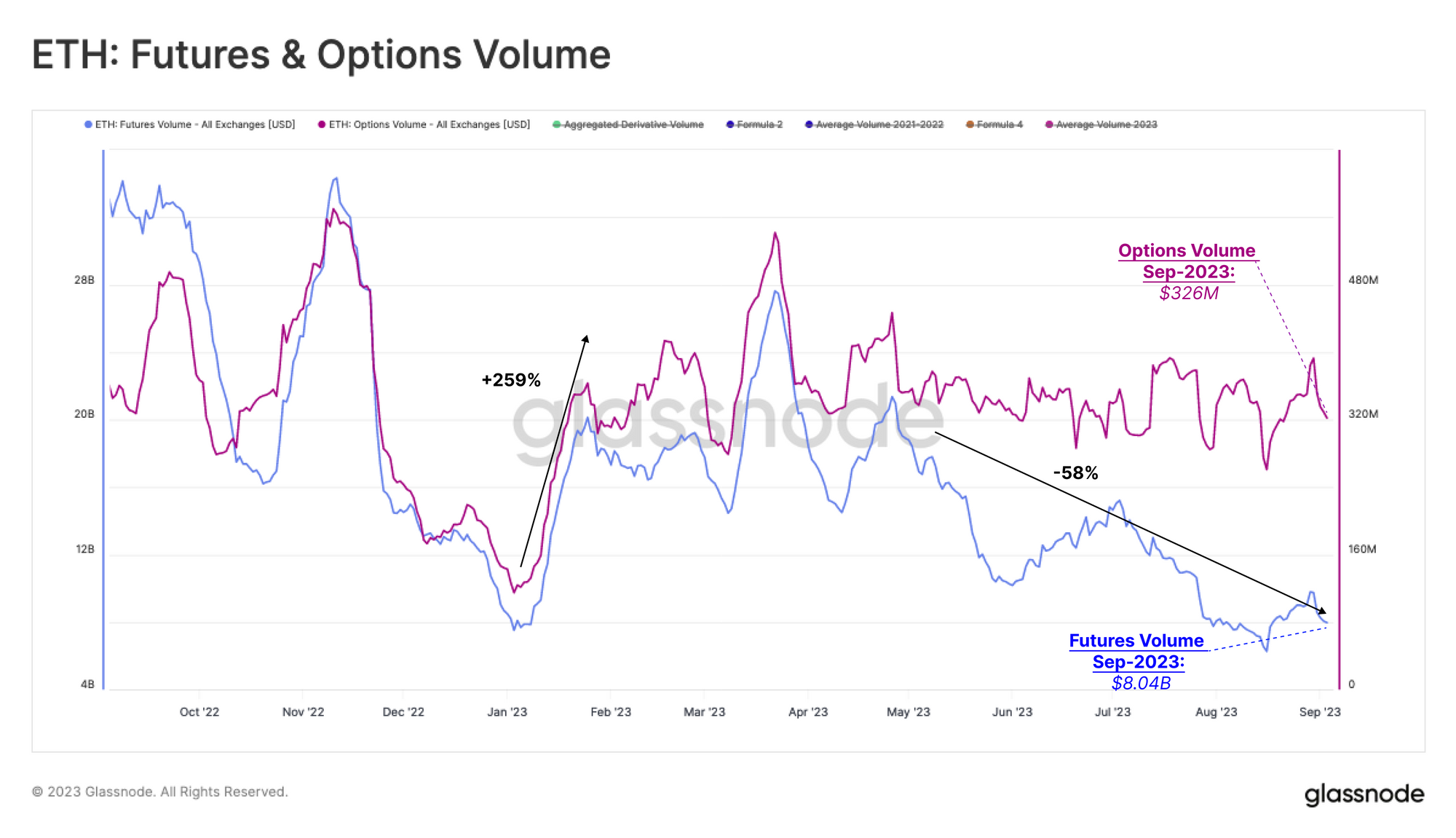

Since the beginning of the year, there has been a notable uptick in Ethereum options markets, with volume rising by +256% to a daily trade of $326M/day. Meanwhile, futures volumes have experienced a steady decline this year, falling from $20B/day in early January, to just $8B.day today. The only notable exception was a brief uptick to around $30B/day around the Shanghai upgrade.

Given there has been no significant shift in trade volumes for either market in August, it suggests that traders are continuing to move liquidity higher up the risk curve.

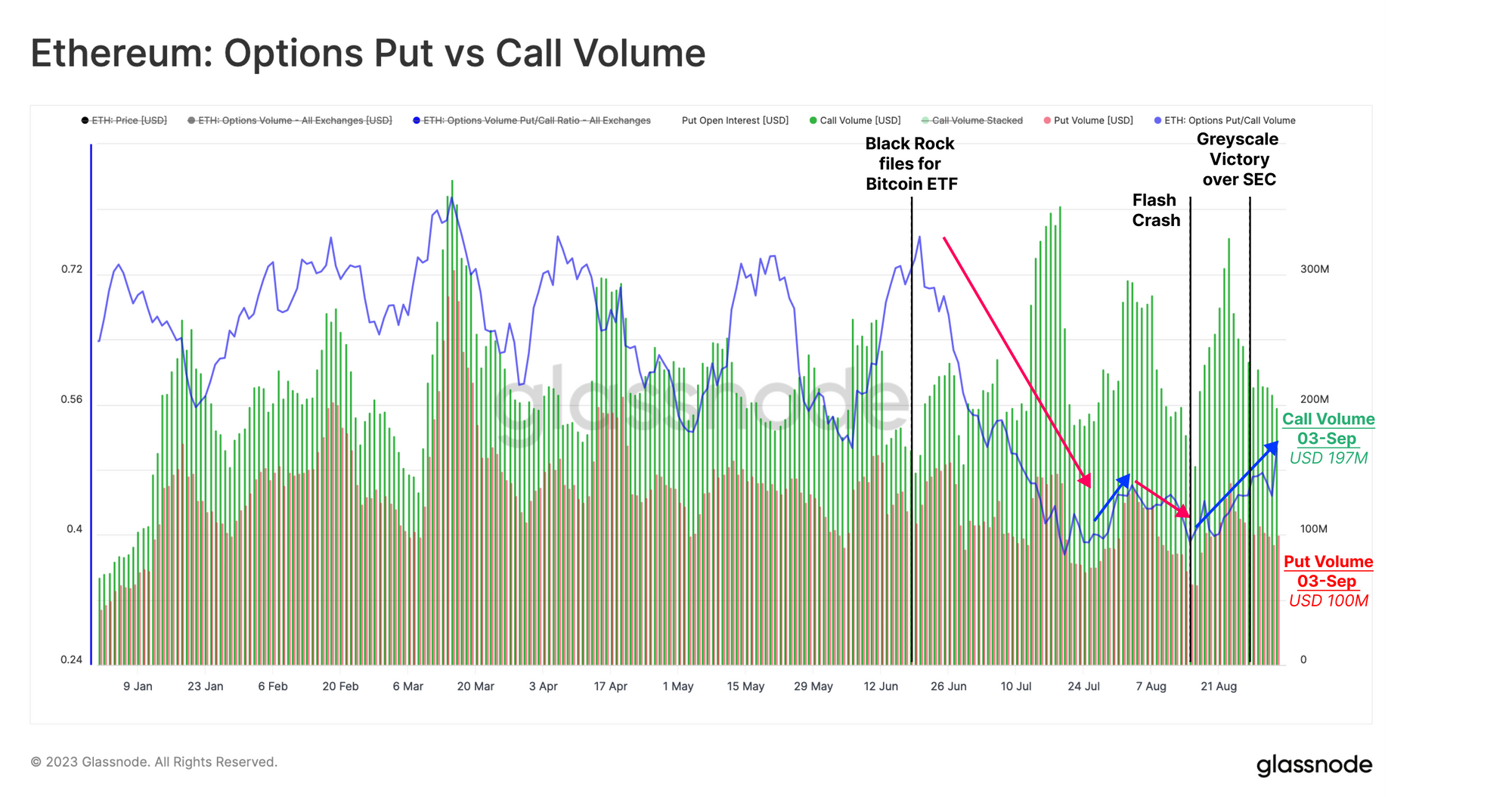

Looking to the Pull/Call ratio, we can see a high degree of responsiveness to major news events. For example, after BlackRock filed for a Bitcoin ETF, sentiment became more bullish, driving the Pull/Call ratio lower from 0.72 to 0.40.

However, this changed with the sell-off on 17-Aug, as the Pull/Call ratio increased to 0.50, and with call volumes dropping strongly from $320M/day to $140M/day.

Are Liquidity Pools Options Markets?

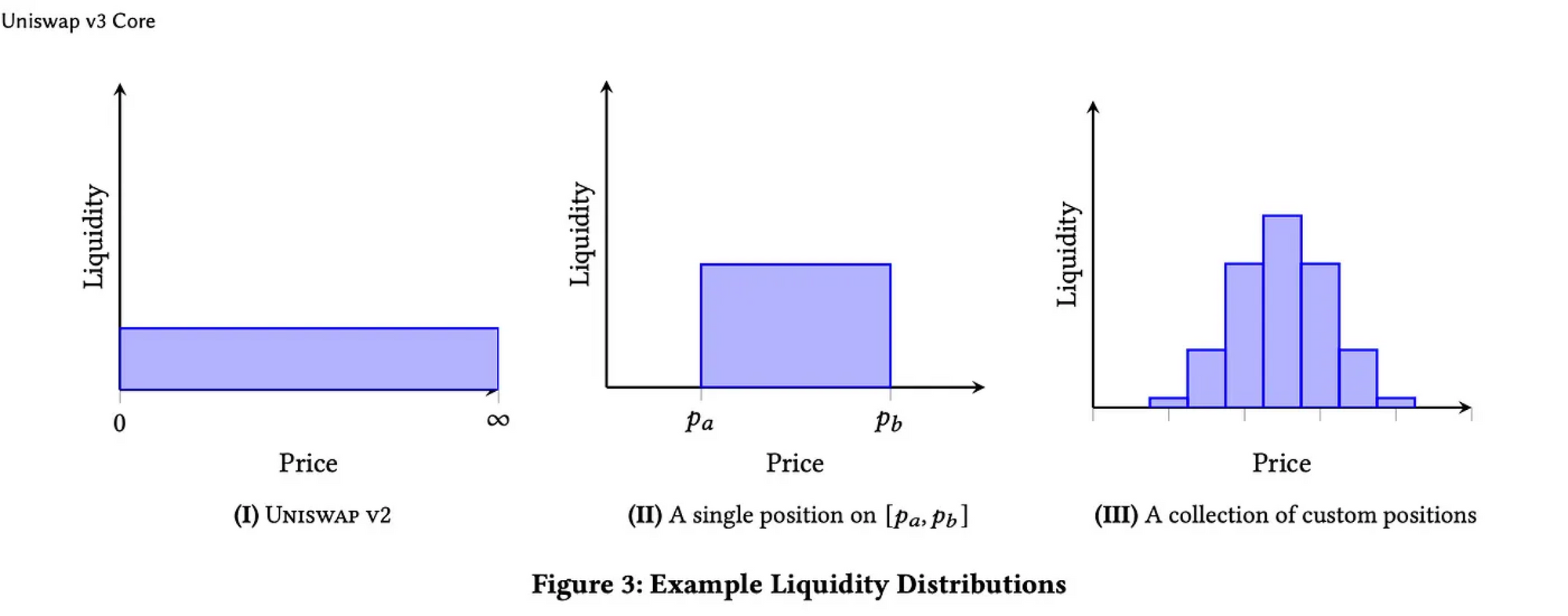

To bolster our analysis above, we will now examine the activities across Automated Market Makers like the Uniswap ETH/USDC Pool. Since the introduction of concentrated liquidity on Uniswap V3, a thesis has circulated Uniswap Liquidity Positions can be considered in a similar light to pricing put and call options. While we do not believe that options concepts describe these dynamics completely, there are certainly many parallels worth exploring further.

Our analysis will focus on the USDC/ETH 0.05% Pool, which is the most active Uniswap pool, and thus can be expected to provide the highest signal. This pool has a 7-day trade volume of $1.51B, and $260m in Total Value Locked (TVL).

Uniswap V3 has a unique feature of concentrated liquidity. Liquidity providers (LPs) can select a price range where their provided liquidity will be concentrated. Fees will only be earned when the market trades in this range (analogous to strike prices), and the tighter the range, the larger the relative fee revenue. This leads to both a better user experience for DEX traders, as spreads tend to be tighter, and improved capital efficiency for LPs.

In this way, it can be argued that the positioning of LPs capital must factor in an expectation of volatility (spread between upper and lower bound), and the expected price ranges (strike level above and below). The thesis is that assuming LPs are actively managing their position, we may be able to draw similar insights to those from options market data.

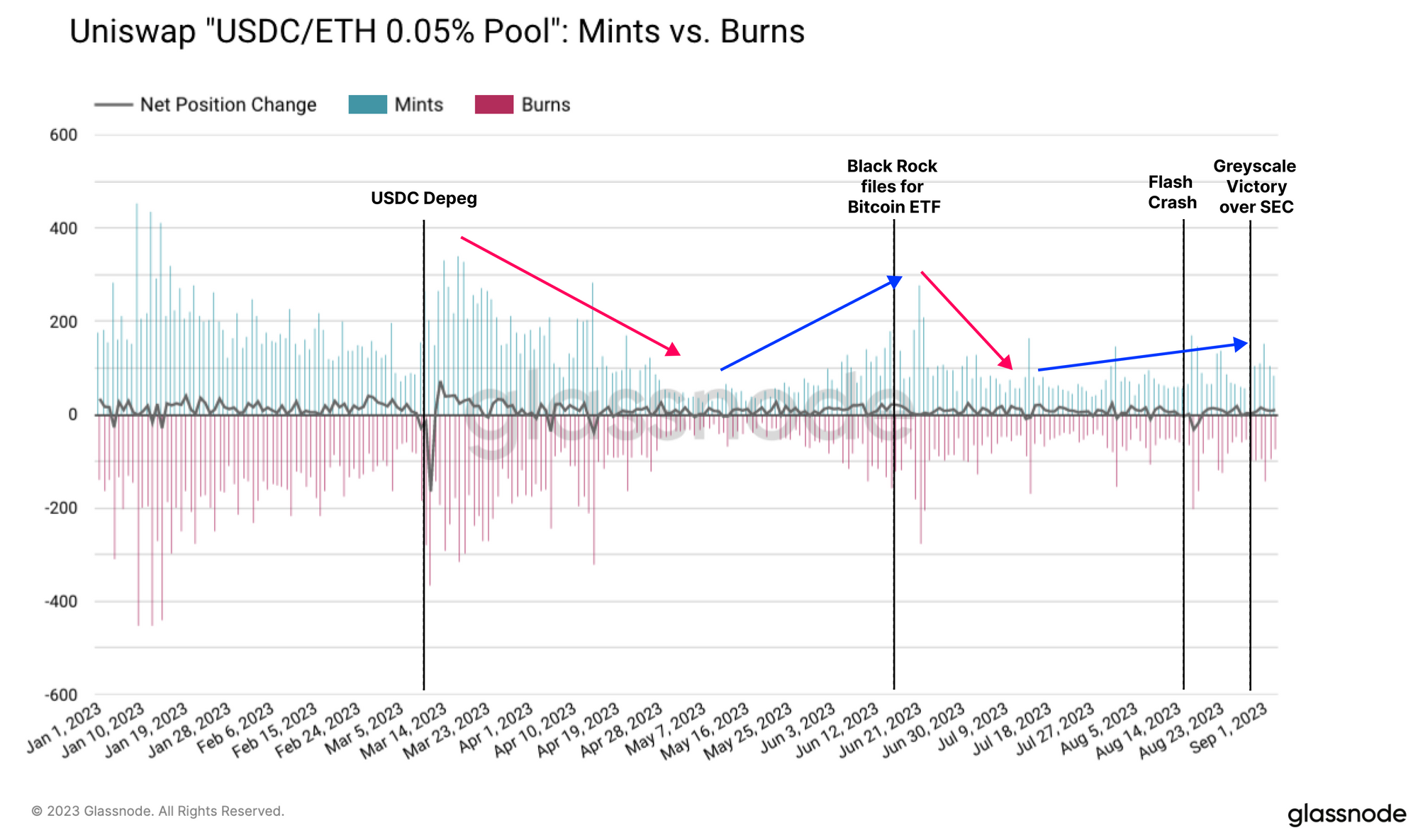

We begin by observing the general activity in the USDC/ETH 0.05% pool. For various reasons, we will avoid using the TVL metric as a gauge of activity in a pool or a respective token pair. Instead, we will express activity terms of two metrics:

- Mints per Day representing the number of liquidity positions opened by LPs, and

- Burns per Day representing the number of liquidity positions closed by LPs.

By these measures, activity contracted after the March banking crisis, and the Shanghai Upgrade in April, and then remained relatively low until early June. We then see a spike in new Mints and Burns around BlackRock ETF announcement, and then again during the 17-Aug sell-off.

The chart below also shows the net change in LP position counts as a measure of the balance between positions opening and closing. We note that this metric is less affected by market trends but more so by discrete events suggesting short-term volatility is a key motivator.

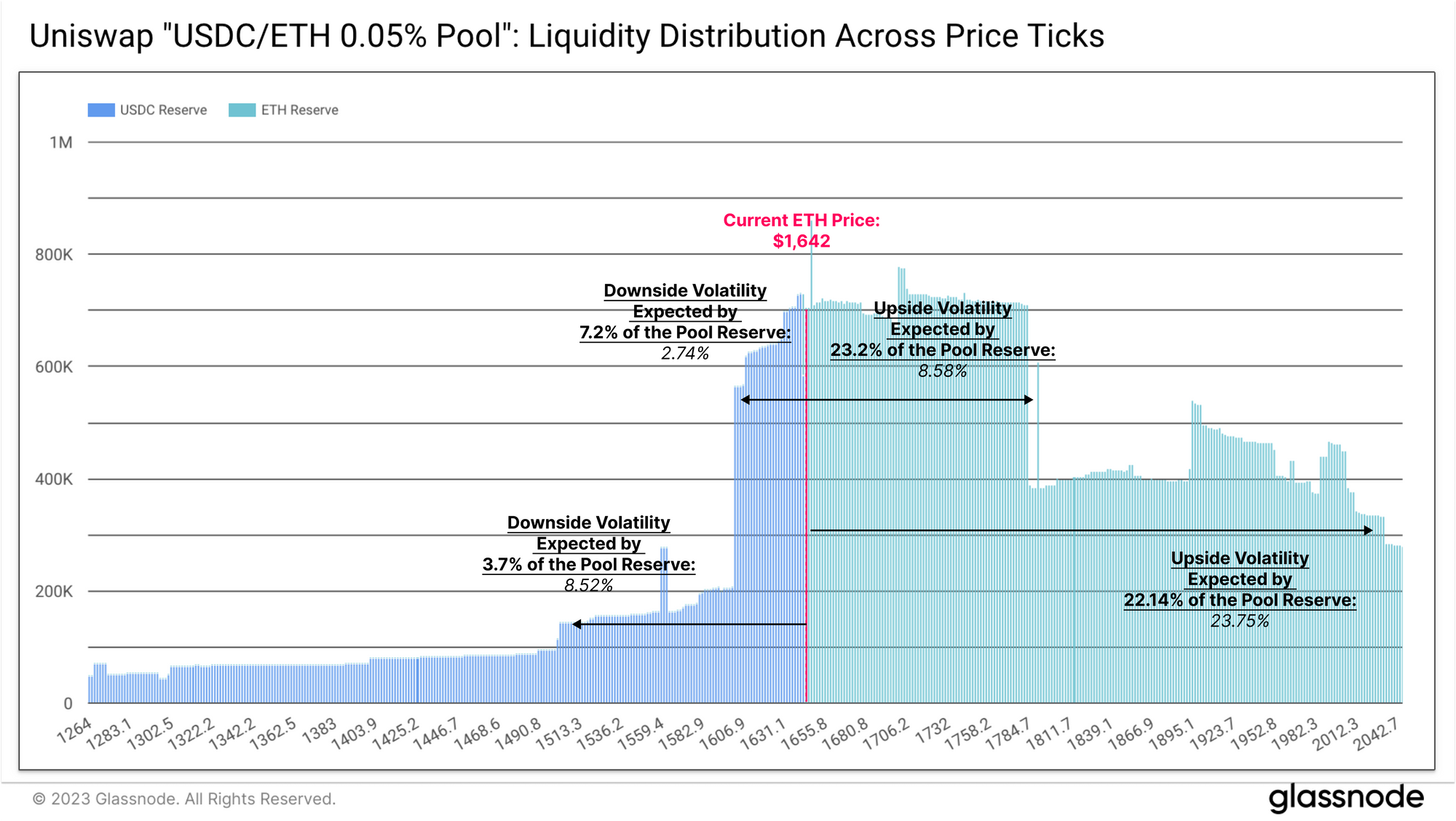

When examining the distribution of liquidity across different price ranges in the Uniswap pool, we can see that LPs are currently supplying a majority of liquidity above the current price tick.

The most concentrated liquidity (approx 30.4% of capital) is located within an 11% price range, with expected downside of -2.7% and upside of +8.6%. A second tier of liquidity is positioned with a -8.5% buffer to the downside, and a +23.7% buffer to the upside. It could be argued that Uniswap LPs are expressing an expectation of optimism and market upside for ETH in general.

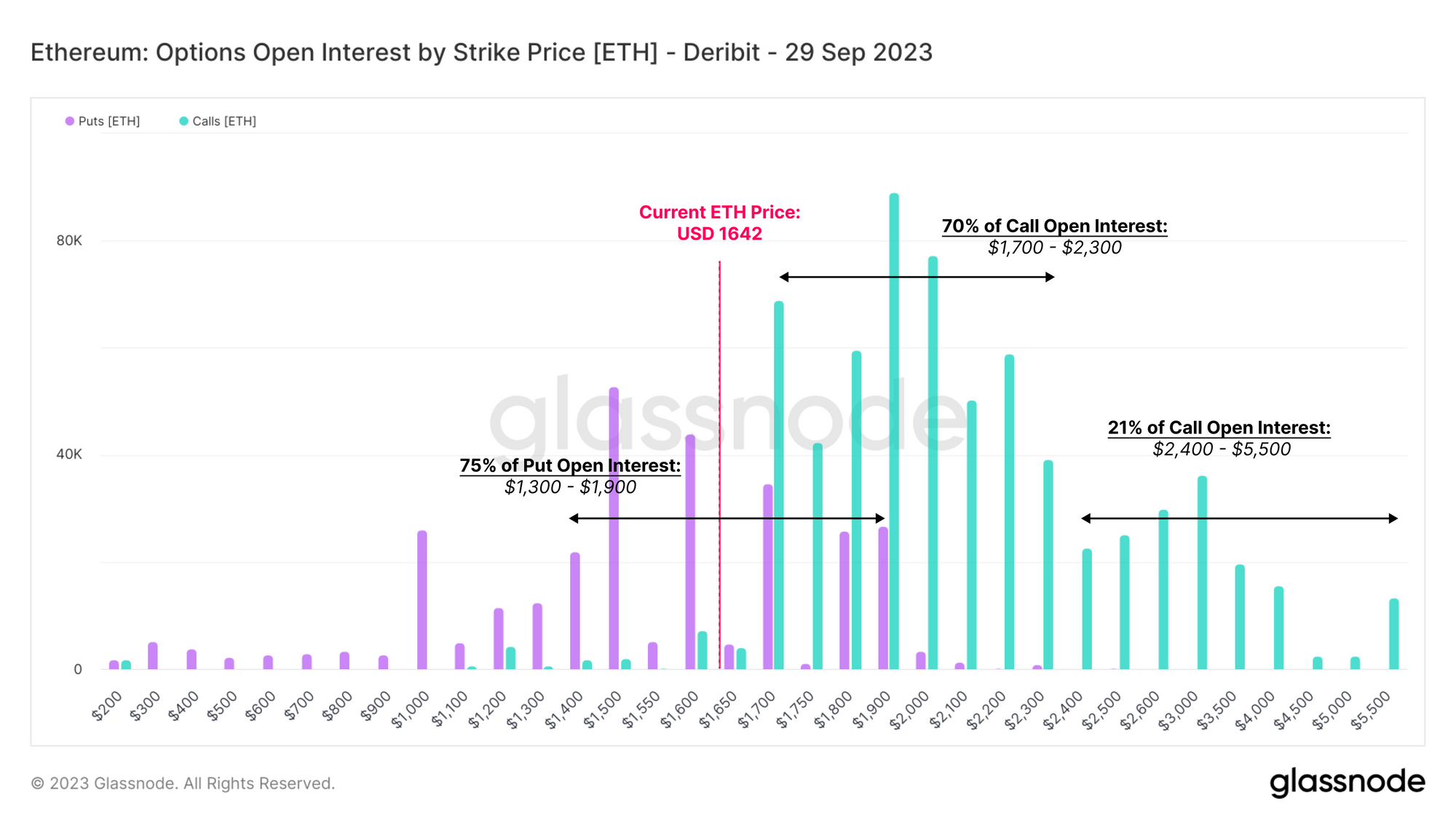

If we compare this to option strike prices for contracts expiring at the end of September, we can see a similar positive outlook. 70% of calls have a strike price between $1.7k and $2.3k, while 75% of puts have a strike between $1.3k and $1.9k. These price levels largely align with the Uniswap Liquidity pool liquidity distribution.

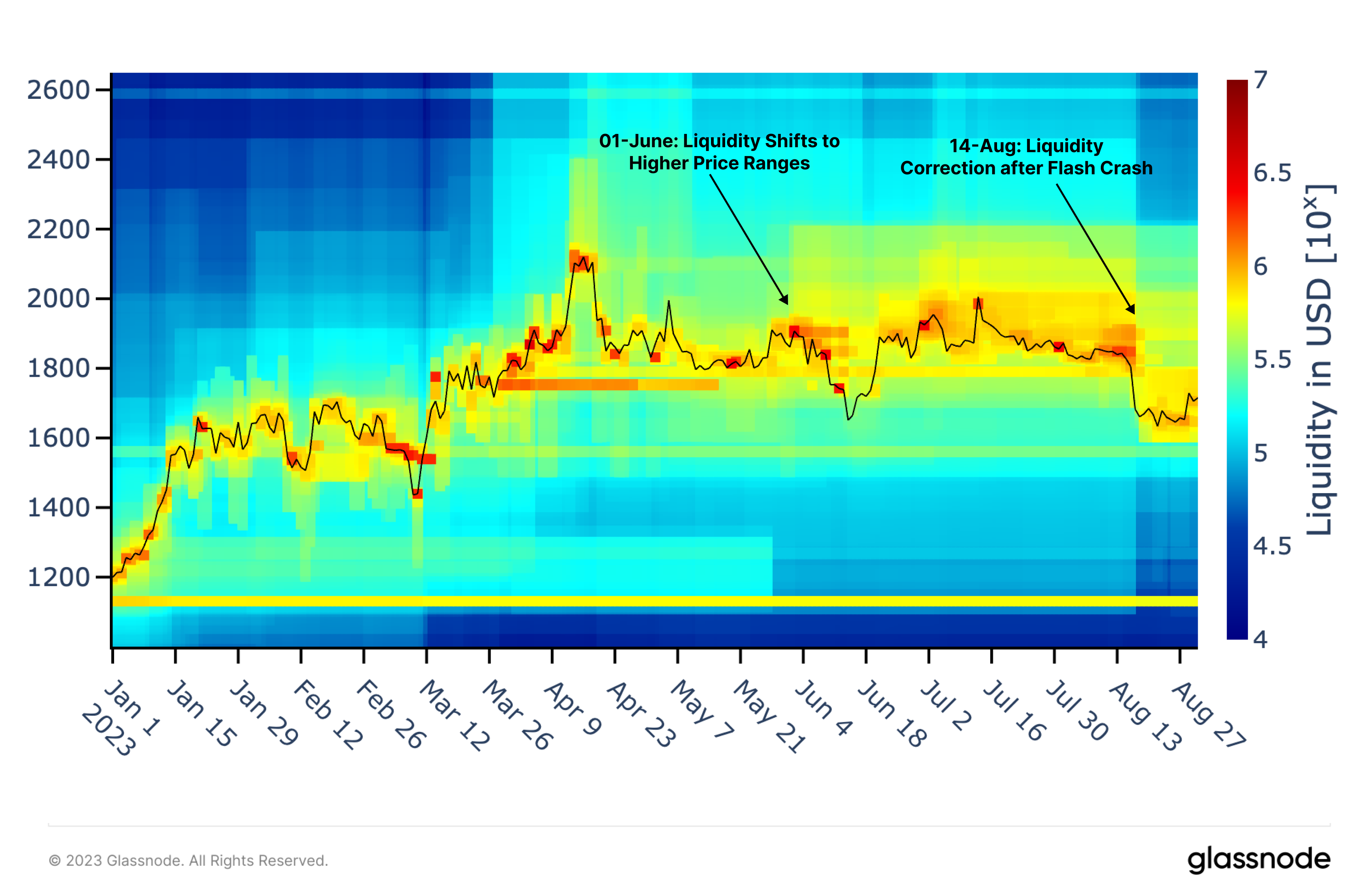

Turning back to the USDC/ETH Uniswap Pool, we can analyze how liquidity concentrations have adjusted over time. The heatmap below shows the density of liquidity, expressed in increasingly cool-to-hot colors.

With the expansion of automated LP strategies and execution, liquidity providers have become quite successful in arranging liquidity very close the spot price during periods of higher volatility. On 1-June, a large amount of liquidity was expanded just above the price at that time (shown in by a deeper yellow zone). This arguably indicated an expectation for higher fee revenue in this zone by market makers. This liquidity prevailed until the flash crash in August, where liquidity concentrations were adjusted to be increasingly below the $1.8k. This chart provides a remarkable view into how responsive LPs are relative to market events and volatility.

It is also interesting to note how high concentrations of liquidity, represented by red zones, coincides with strong price movements and often times trend reversals. By inspection, is does indicate that Uniswap liquidity pools could indeed be a valuable source of information for gauging market sentiment and positioning.

Summary and Conclusion

The initial optimism surrounding Grayscale's victory over the SEC was short-lived, with Ethereum's value dipping back to the August lows within a matter of days. Spot markets continue seeing capital outflows, and derivative markets are also witnessing a persistent decline in liquidity. Overall, investors appear hesitant to return to the markets, preferring to move capital higher up the risk curve.

We performed a study on Uniswap liquidity pools, seeking to identify if similar pricing information to options markets could be obtained. Our analysis demonstrates that liquidity capital is quite responsive to market events, and that insights can likely be found with respect to the volatility and price expectations of LPs.

Disclaimer: This report does not provide any investment advice. All data is provided for information and educational purposes only. No investment decision shall be based on the information provided here and you are solely responsible for your own investment decisions.

- Join our Telegram channel

- Follow us and reach out on Twitter

- Visit Glassnode Forum for long-form discussions and analysis.

- For on-chain metrics, dashboards, and alerts, visit Glassnode Studio

- For automated alerts on core on-chain metrics and activity on exchanges, visit our Glassnode Alerts Twitter