Coinbase + Glassnode: Q1 Guide to Crypto Markets

Institutional capital flows, stablecoin growth, and Layer-2 adoption are reshaping crypto markets in 2025. Our latest Guide to Crypto Markets, in collaboration with Coinbase Institutional, provides data-driven insights on BTC, Ethereum’s network trends, and stablecoins’ expanding role.

As we enter 2025, the crypto markets continue to gain momentum, shaped by structural shifts in liquidity, investor positioning, and on-chain activity. Institutional adoption remains a dominant theme, with spot Bitcoin ETFs attracting record inflows, Ethereum’s Layer-2s driving network growth, and stablecoins cementing their role as crypto’s financial backbone.

In collaboration with Coinbase Institutional, our latest Guide to Crypto Markets provides a comprehensive, data-driven analysis of these trends. From capital flows and derivatives positioning to macro market structure, this report equips institutional investors with the insights needed to navigate the shifting landscape.

This quarter, we explore:

- Bitcoin’s evolving supply dynamics as profit-taking at cycle highs reshapes market structure.

- Ethereum’s Layer-2 acceleration, with surging activity and lower fees fueling adoption.

- Stablecoins' growing dominance, as on-chain liquidity reaches all-time highs.

The Evolving Bitcoin Landscape

Bitcoin’s institutional adoption reached new heights in Q4 2024, with spot ETFs seeing record inflows and derivatives markets expanding significantly. However, on-chain data reveals a more nuanced picture - while demand surged, long-term holders also seized the opportunity to take profits near all-time highs, reshaping market structure in the process.

ETF Inflows Drive Institutional Demand

The launch of spot Bitcoin ETFs in early 2024 was a watershed moment for institutional access to crypto markets. By year-end, total BTC ETF balances exceeded $105B, with Q4 alone adding $16.6B in net inflows.

This surge in demand has helped solidify Bitcoin’s position as a macro-relevant asset, increasingly integrated into traditional investment portfolios. Yet, as ETF demand grew, on-chain data signaled shifts in supply dynamics that investors must watch closely.

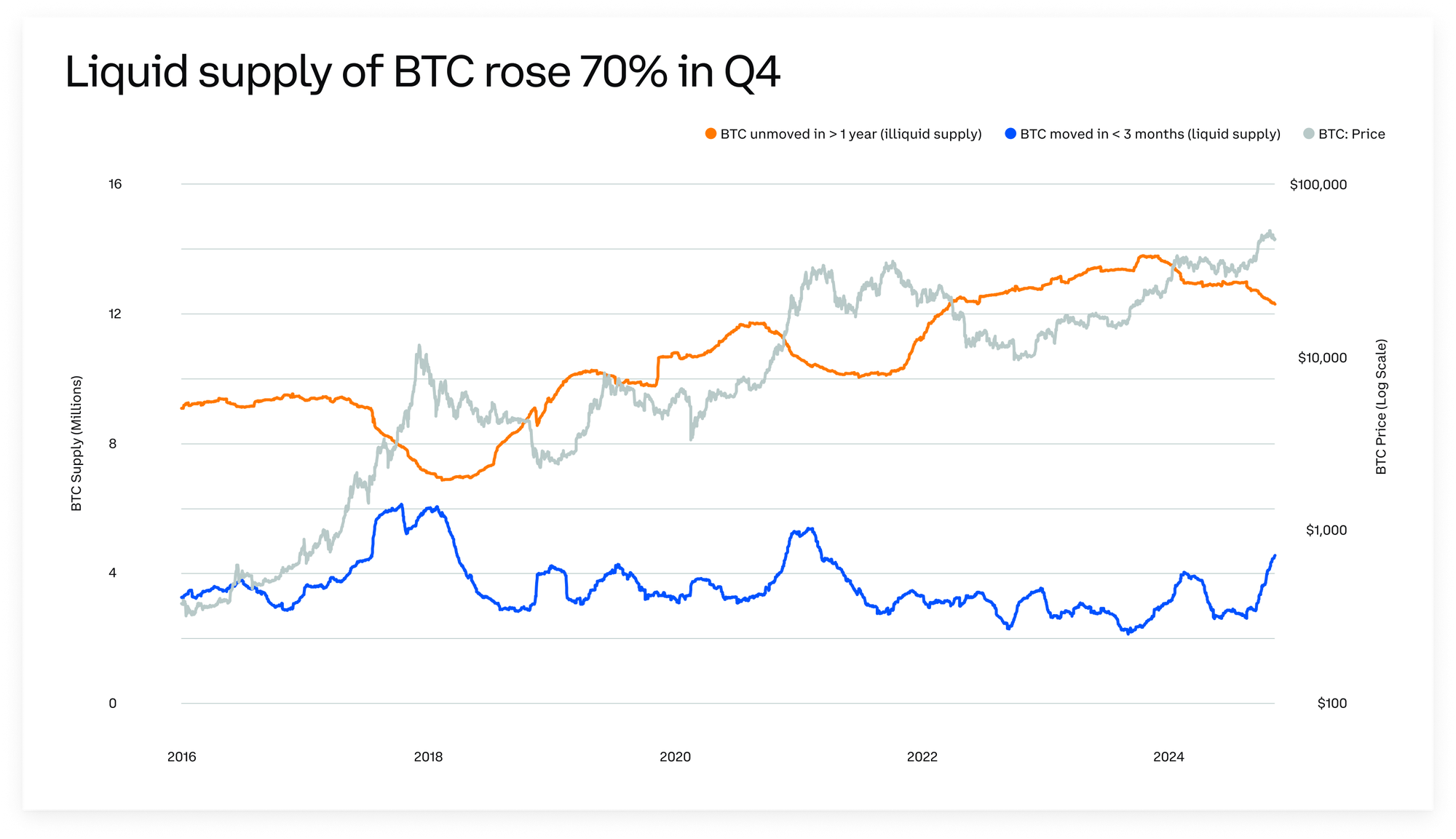

Profit-Taking Reshapes Market Structure

As Bitcoin rallied to new highs in Q4, long-term holders began distributing coins into market strength. Active supply - BTC that moved within the last three months - rose nearly 70%, bringing over 1.8M BTC into active circulation.

This suggests that for many long-term investors, $100K was viewed as a strategic profit-taking level, leading to a redistribution of supply from seasoned holders to newer market participants. However, despite this increase in liquid supply, the overall uptrend remained intact, reflecting strong underlying demand.

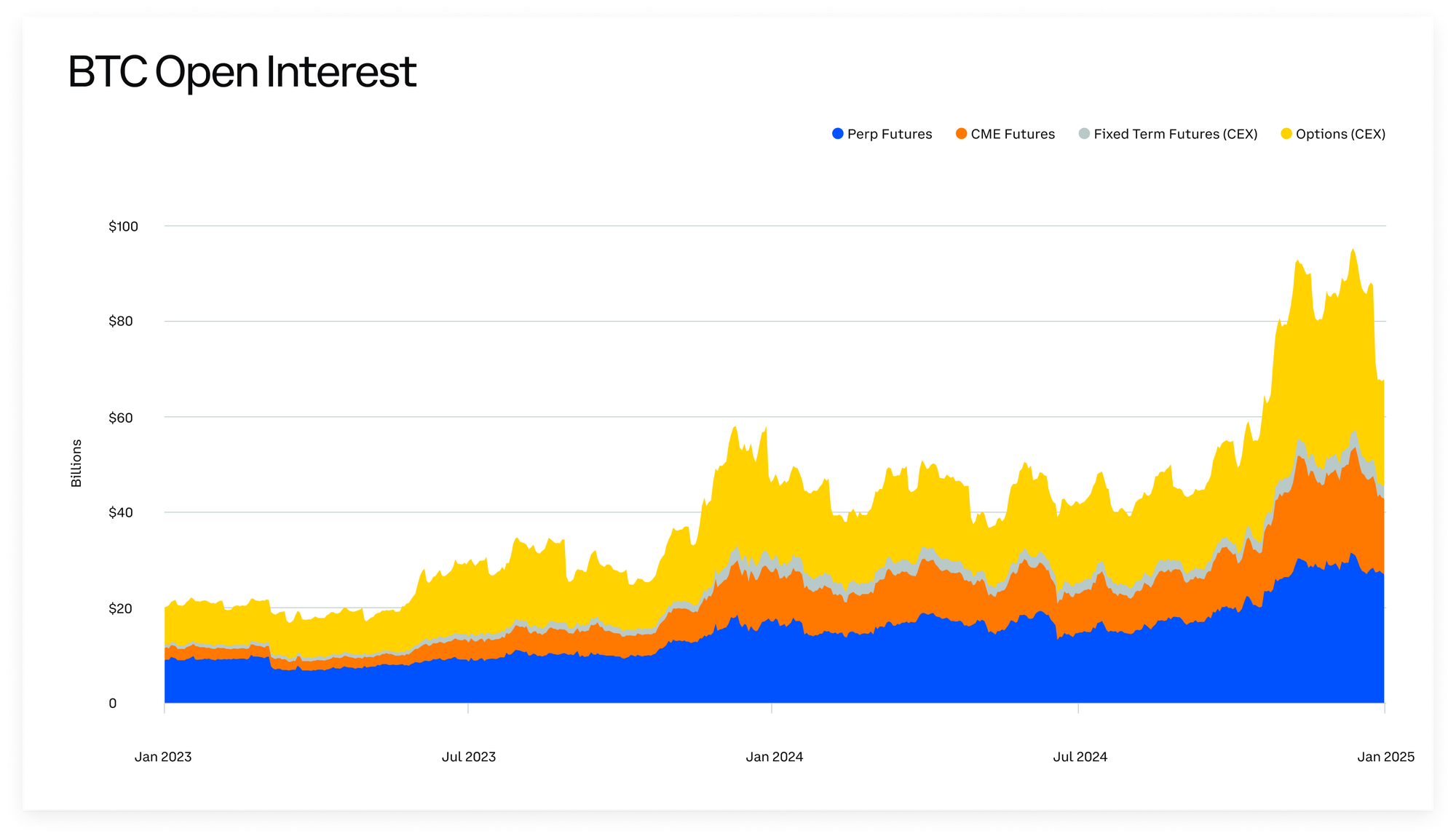

Derivatives Markets Signal Elevated Risk Appetite

Institutional participation extended beyond ETFs, with Bitcoin derivatives markets seeing a sharp expansion in Q4:

- Futures open interest surged 60% to nearly $100B, reflecting increased positioning activity.

- Perpetual funding rates spiked, indicating a strong tilt toward bullish positioning.

- Large liquidation events followed Bitcoin’s brief move above $100K, signaling moments of excess leverage being flushed from the system.

The combination of growing institutional inflows, shifting supply dynamics, and aggressive derivatives positioning makes Bitcoin’s market structure one of the most important factors to monitor in early 2025.

Ethereum’s Layer-2 Expansion Continues

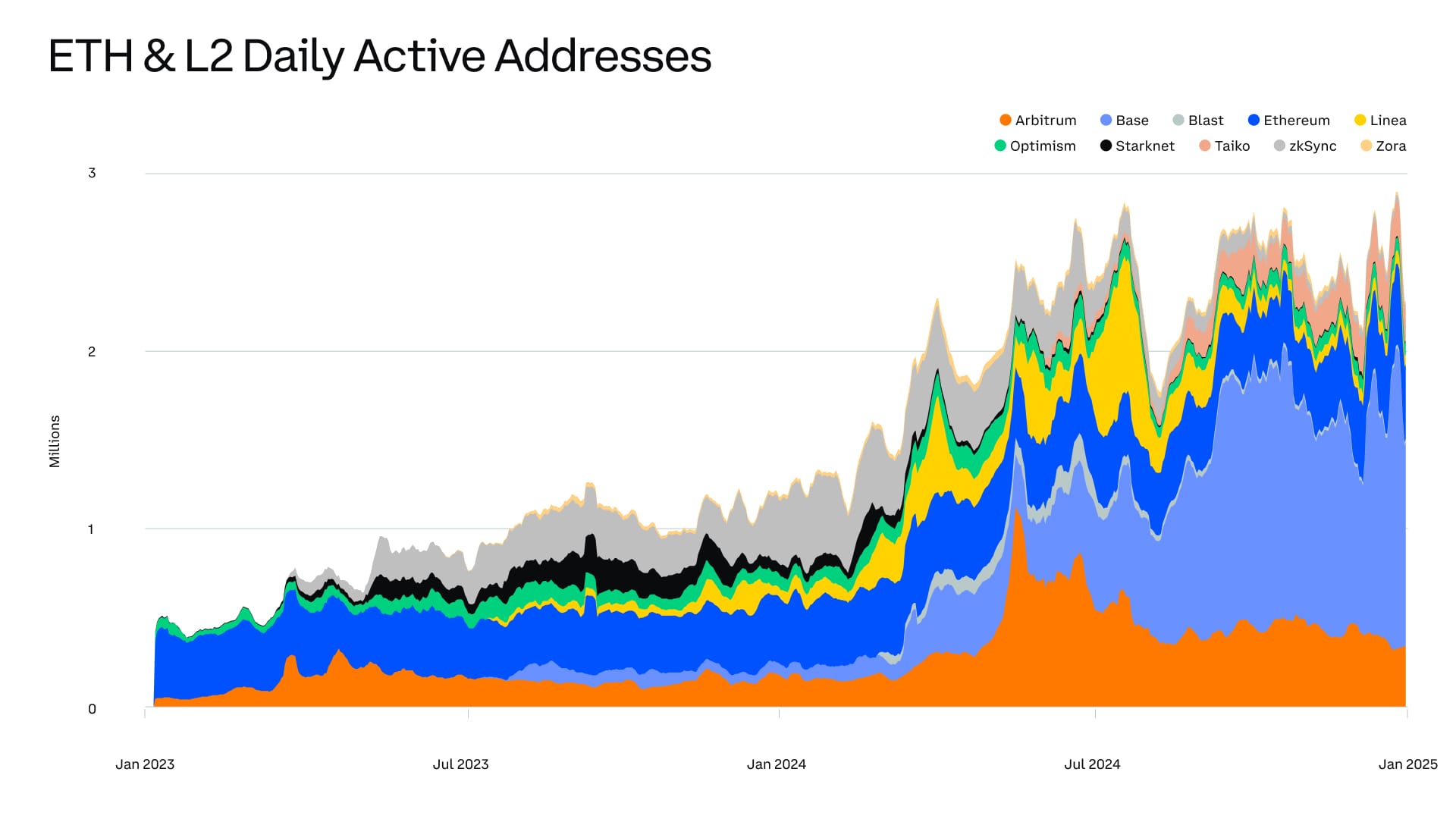

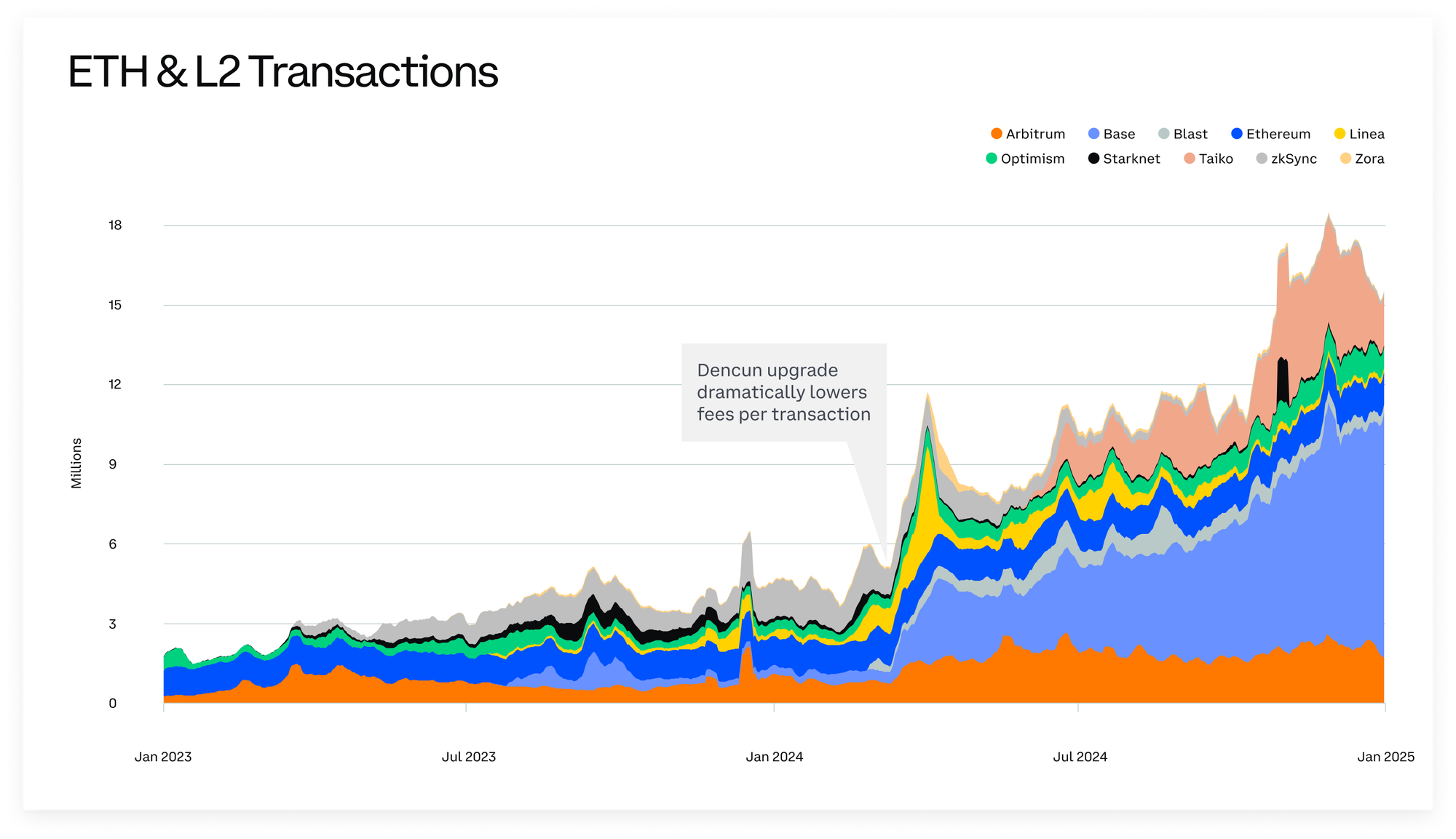

Ethereum’s network activity surged in Q4 2024, with Layer-2 solutions playing an increasingly dominant role in transaction execution. While Ethereum’s price remained largely rangebound, the underlying network dynamics are noteworthy - daily transactions and active addresses soared, driven by efficiency gains from Layer-2 adoption.

Layer-2s Take the Lead in Network Growth

Ethereum’s rollup-centric roadmap continues to materialize, with Layer-2 networks absorbing a growing share of transaction activity. In Q4 alone:

- Daily transactions across Ethereum and L2s increased by 41%, reflecting strong user adoption.

- Base led activity growth, with surging transaction counts following its rapid expansion.

- Layer-2 adoption outpaced Ethereum mainnet, highlighting a shift toward cheaper, faster execution environments.

These trends increased in momentum with the March 2024 Dencun upgrade, which dramatically lowered Layer-2 transaction fees. The cost reductions made Layer-2s an even more attractive settlement layer, unlocking new use cases across DeFi, payments, and gaming.

Staking and DeFi Participation Remain Strong

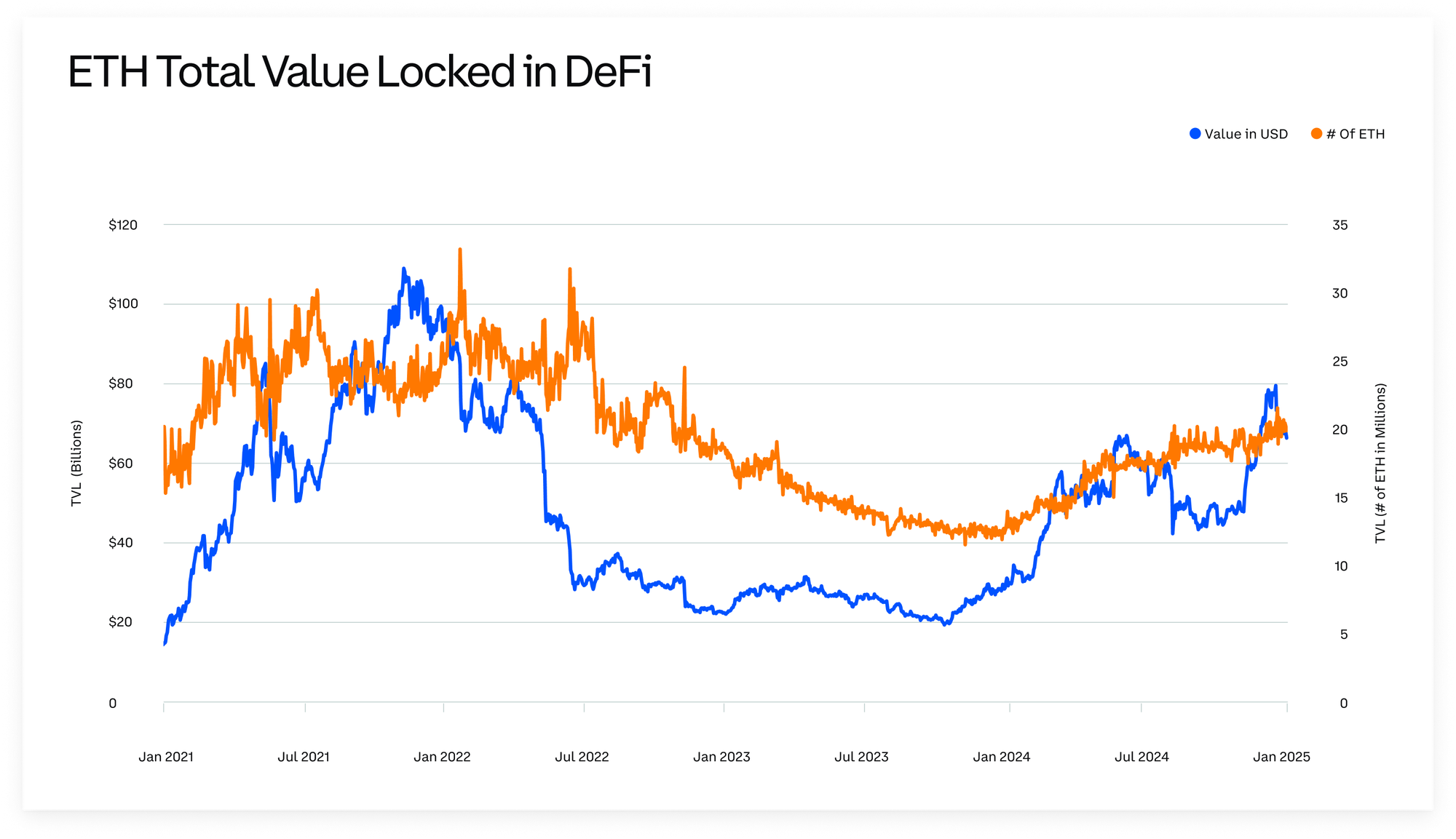

Beyond transaction growth, Ethereum’s staking and DeFi ecosystems showed resilience:

- ETH staked remained near all-time highs, despite minor declines in Q4.

- Annual staking yield stabilized around 3%, providing a predictable reward structure.

- Total Value Locked (TVL) in DeFi rose 6% in Q4 and 58% for the year, indicating sustained engagement in on-chain financial applications.

Looking Ahead: The Layer-2 Landscape in 2025

With Layer-2s proving their ability to scale Ethereum while maintaining security guarantees, 2025 is poised to be a defining year for their adoption. The next phase of competition will likely revolve around:

- Liquidity fragmentation and interoperability - how assets flow seamlessly across different rollups.

- New L2-native applications - as developers build directly on rollups, bypassing mainnet constraints.

- Institutional adoption - whether capital allocators begin viewing Layer-2s as viable infrastructure for larger financial applications.

Stablecoins Take Off as On-Chain Liquidity Grows

While Bitcoin and Ethereum dominated market headlines in Q4 2024, stablecoins quietly cemented their role as the backbone of on-chain liquidity. Record supply growth and surging transaction volumes signal that stablecoins are fast becoming a core settlement layer for digital finance.

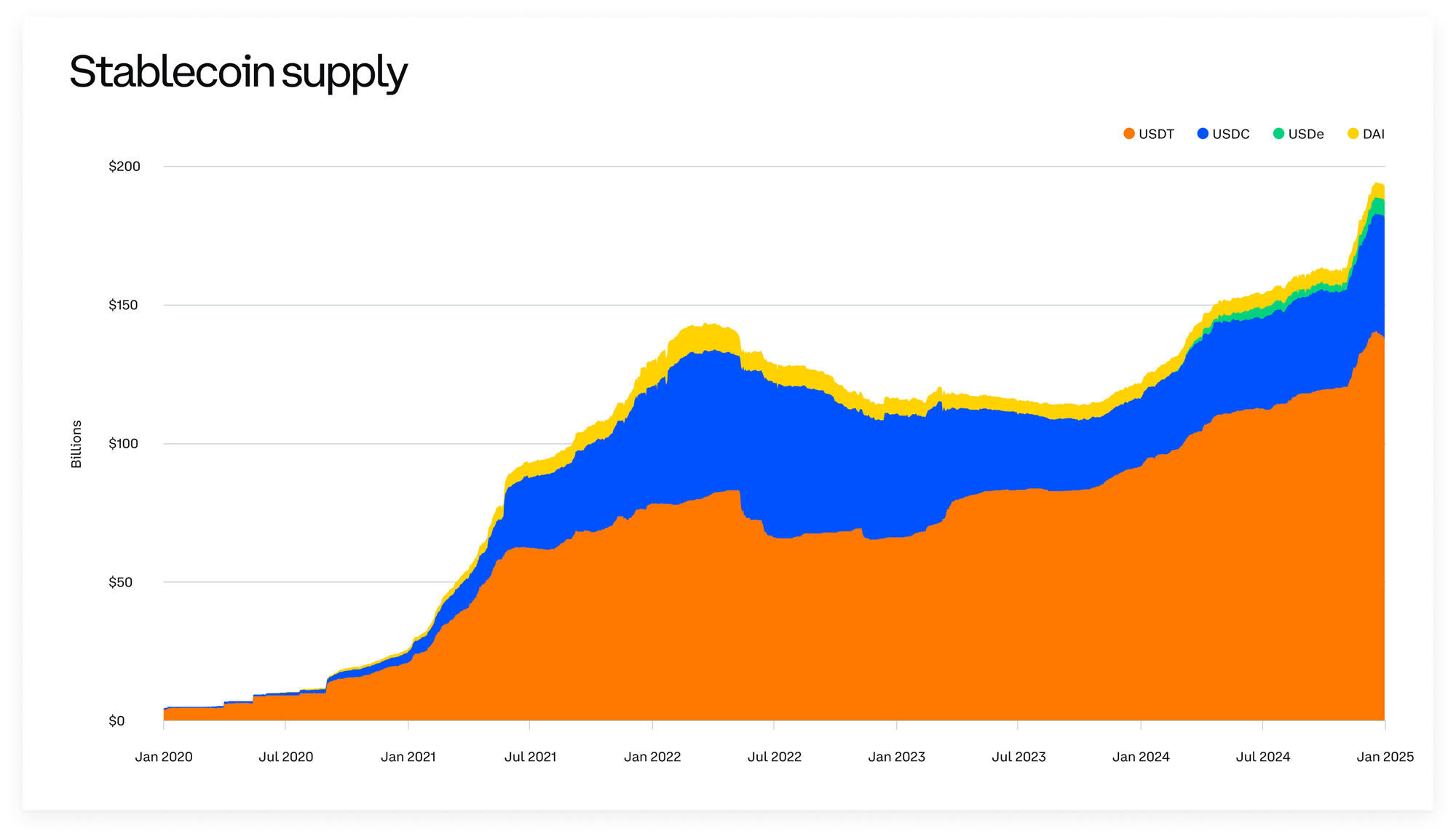

Stablecoin Supply Surges to Record Highs

In Q4, total stablecoin supply grew by 18%, pushing the combined market value of the largest stablecoins toward $200B. This growth reflects:

- Increased demand for stable, liquid on-chain assets, particularly as institutions deepen their engagement with crypto markets.

- A shift toward stablecoins as an alternative to traditional banking rails, with more entities using them for settlements and remittances.

- The continued dominance of USDT, which captured the majority of new inflows, while emerging stablecoins like USDe gained traction.

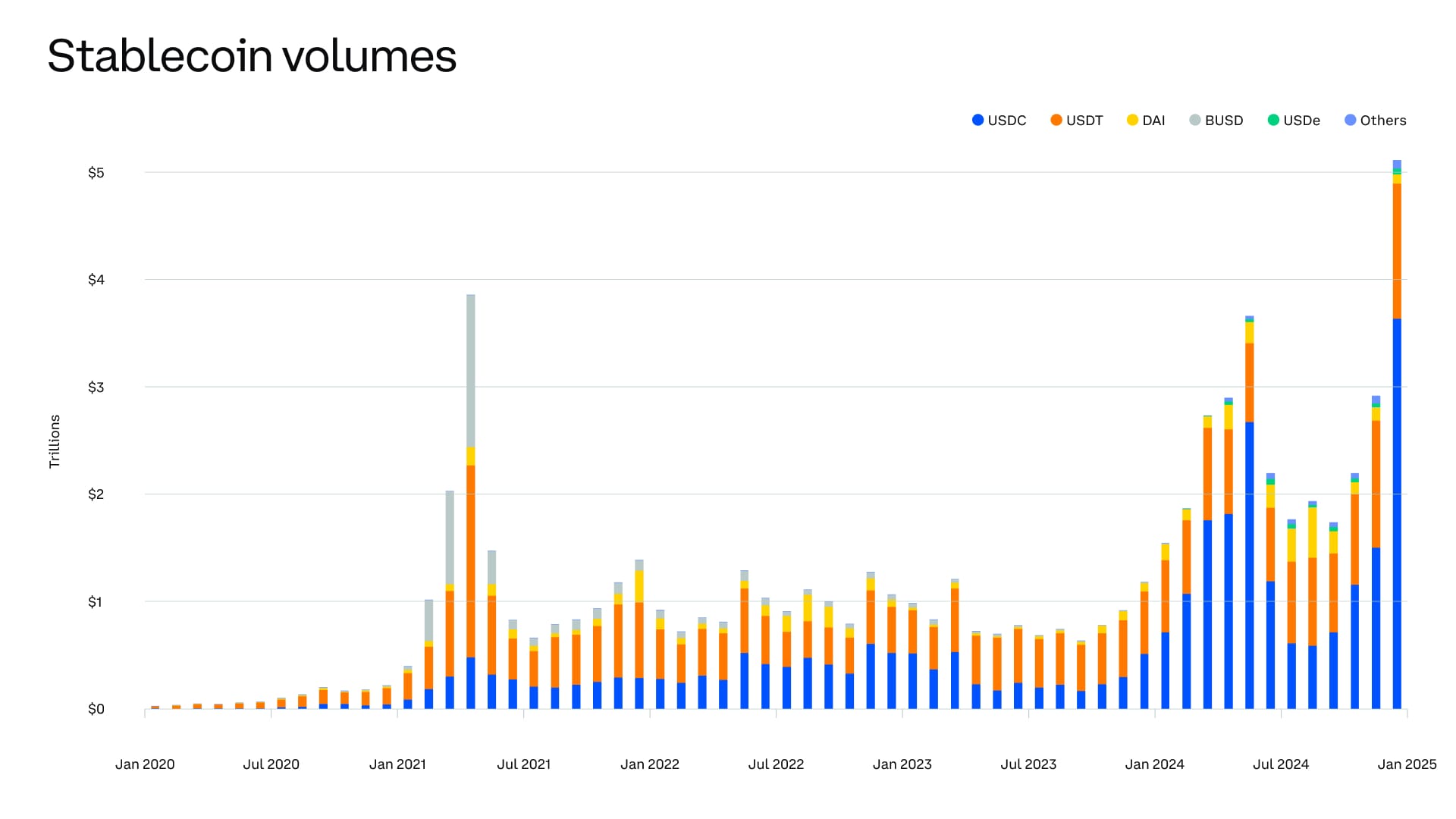

Transaction Volumes Hit New Highs

Beyond supply expansion, stablecoins also saw a record-breaking surge in transaction activity:

- Stablecoin transaction volumes reached $30T in 2024, with December alone posting a record $5T in transfers.

- On-chain settlement efficiency continued improving, with lower fees and faster transactions across major networks.

- Ethereum remains the dominant settlement layer, but alternative chains and Layer-2 networks are increasingly handling stablecoin flow.

This unprecedented velocity of stablecoin movement underscores their growing utility - not just as a store of value, but as a preferred medium for cross-border payments, remittances, and digital commerce.

Stablecoins at the Core of Institutional Crypto Adoption

With institutions exploring tokenized assets and on-chain finance, stablecoins are becoming an essential liquidity layer for institutional market participants. The key drivers for continued adoption in 2025 include:

- Regulatory clarity - as governments formalize stablecoin frameworks, adoption is likely to accelerate.

- DeFi integration - stablecoins continue to underpin lending, derivatives, and automated market-making across decentralized platforms.

- Payments and remittances - corporates and financial institutions are increasingly testing stablecoins for cross-border transactions.

What’s Next?

Stablecoins have long been regarded as crypto’s “killer app,” but Q4 2024 provided clear evidence that they are evolving beyond just a fiat alternative. With regulatory developments, deeper institutional adoption, and broader on-chain integration, stablecoins are positioned to play a defining role in the next phase of digital asset markets.

Conclusion: The Institutional Market View for 2025

Crypto markets are entering 2025 with strong institutional momentum. Spot Bitcoin ETFs have reshaped market structure, Layer-2s are scaling Ethereum, and stablecoins are solidifying their role as the foundation of on-chain liquidity.

Key takeaways from Q4:

- Bitcoin: Institutional demand remains strong, but on-chain data signals shifts in long-term holder behavior.

- Ethereum: Layer-2 adoption is accelerating, driving efficiency gains and broader network activity.

- Stablecoins: Growing supply and record transaction volumes highlight their expanding role in global finance.

Institutional investors require a comprehensive view of these structural shifts - beyond price action - to navigate this evolving landscape. Download the full report for in-depth analysis, data-driven insights, and a closer look at the trends shaping digital assets in Q1 2025.

Download the full report here.

Glassnode remains committed to providing the highest quality data and analysis to support institutional investors in the world of digital assets. Contact us for bespoke reports, data services, and more. For more reports on the current trends in the crypto markets, please visit our Insights blog.