CoinMarketCap + Glassnode: Analysing the Ethereum Beacon Chain

With the Ethereum Merge on the horizon, we present a suite of new metrics which describe Proof-of-Stake consensus, and profile the performance of the Beacon Chain since genesis in a new report with CoinMarketCap.

The Ethereum Merge is one of the most impressive engineering feats to take place the cryptocurrency industry, and the event is fast approaching. The Merge marks the end of many years of research, engineering, and development, and will transition the Ethereum blockchain from Proof-of-Work, to a Proof-of-Stake consensus mechanism.

In many ways, this event could be considered the equivalent of the swapping out the engine of a $200 Billion jet, which is also carrying hundreds of Billions of dollars worth of financial infrastructure, whilst also travelling at full speed.

The Merge has been formally scheduled to take place at a Total Terminal Difficulty of 58.75e21, which is estimated to be on the 15-September-2022. With the Merge date just days away, this report will introduce a suite of new metrics to help understand the Ethereum Proof-of-Stake system, and will profile the performance of the Beacon Chain since the genesis block on 1-Dec-2020.

The terminal total difficulty has been set to 58750000000000000000000.

— vitalik.eth (@VitalikButerin) August 12, 2022

This means the ethereum PoW network now has a (roughly) fixed number of hashes left to mine.https://t.co/3um744WkxZ predicts the merge will happen around Sep 15, though the exact date depends on hashrate. pic.twitter.com/9YnloTWSi1

Block Production and Participation

The block production process on the Beacon Chain has a few additional steps than an equivalent Proof-of-Work chain. In a PoW system, miners are responsible for block construction, and then broadcast their winning block to a network of nodes, who then validate that the included transactions and block template meet the consensus rules.

In the Ethereum PoS system, block production and validation goes through the following steps:

- The PoS blockchain is constructed from a series of slots, which occur at an average interval of 12 seconds. Each slot represents an opportunity for a validator to build and propose a block.

- Each sequential set of 32 slots (6.4-mins) are grouped into an Epoch.

- A set of 128 validators are selected by the protocol to form a committee for each Epoch.

- One validator of this committee is algorithmically chosen to Propose a Block in the upcoming Slot.

- The remaining validators in the committee provide Attestations that the proposed block and included transactions follow the consensus rules.

- Epochs are then systematically finalized by two-thirds of the validator network.

The Beacon Chain genesis block was on 1-Dec-2020, and this new network has now been operational for 639-days (1.77years) at the time of writing. The chain-tip has surpassed block height 4,557,056, and epoch height 142,408.

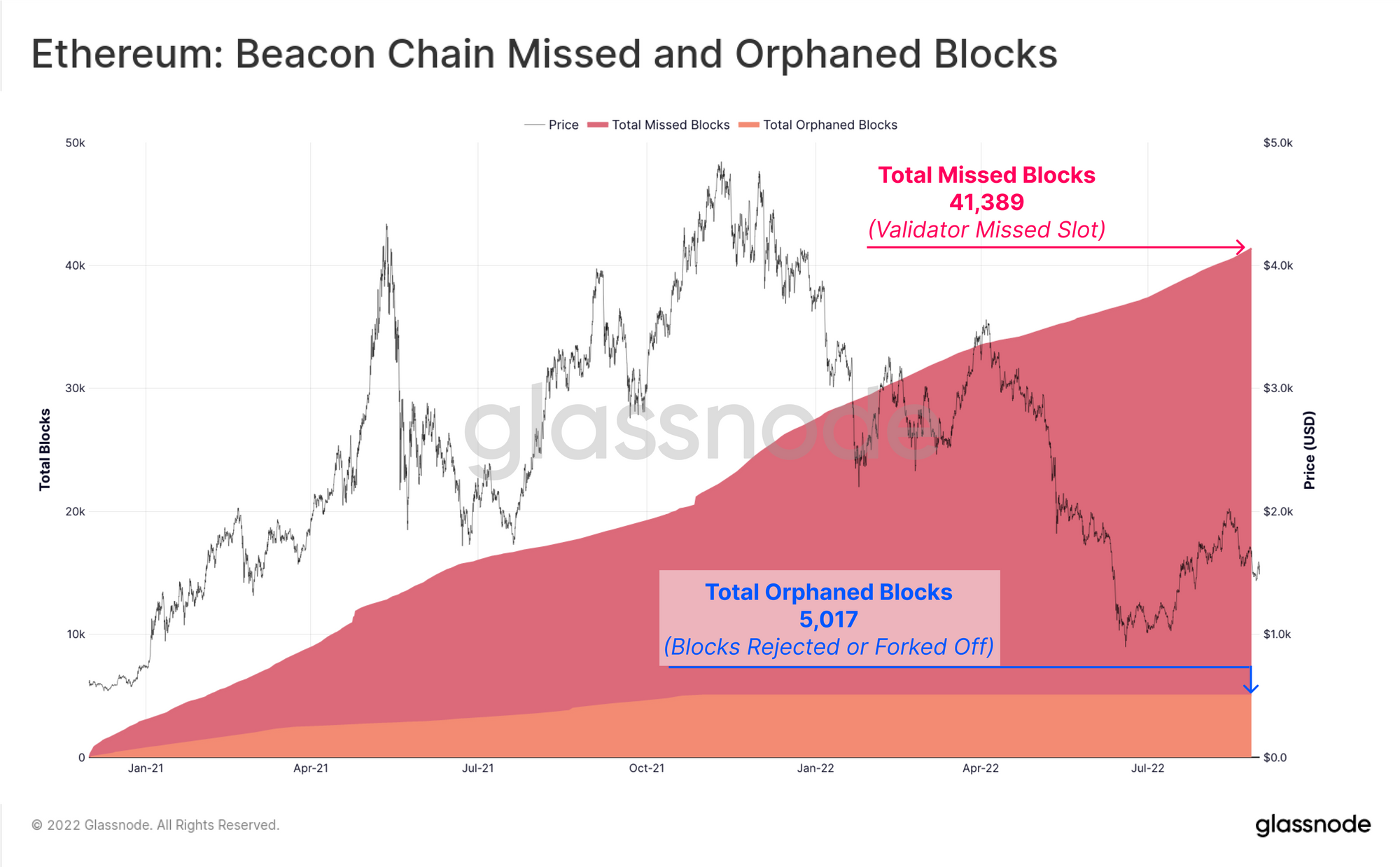

Each slot can be thought of as an opportunity for a block to be produced. In the event that the validator selected for block production is offline, or fails to successfully propose a block, the slot is considered to be Missed. So far, a total of 41,389 slots have been missed, which represents just 0.908% of total slots to date.

There are other instances where a block is rejected by the attesting validators, or results in a naturally occurring fork. These blocks are called orphans, and represent an alternative version of block-history which was not followed by the majority of the network. Just 5,017 orphan blocks have been produced on the Beacon Chain so far, accounting for just 0.110% of slots.

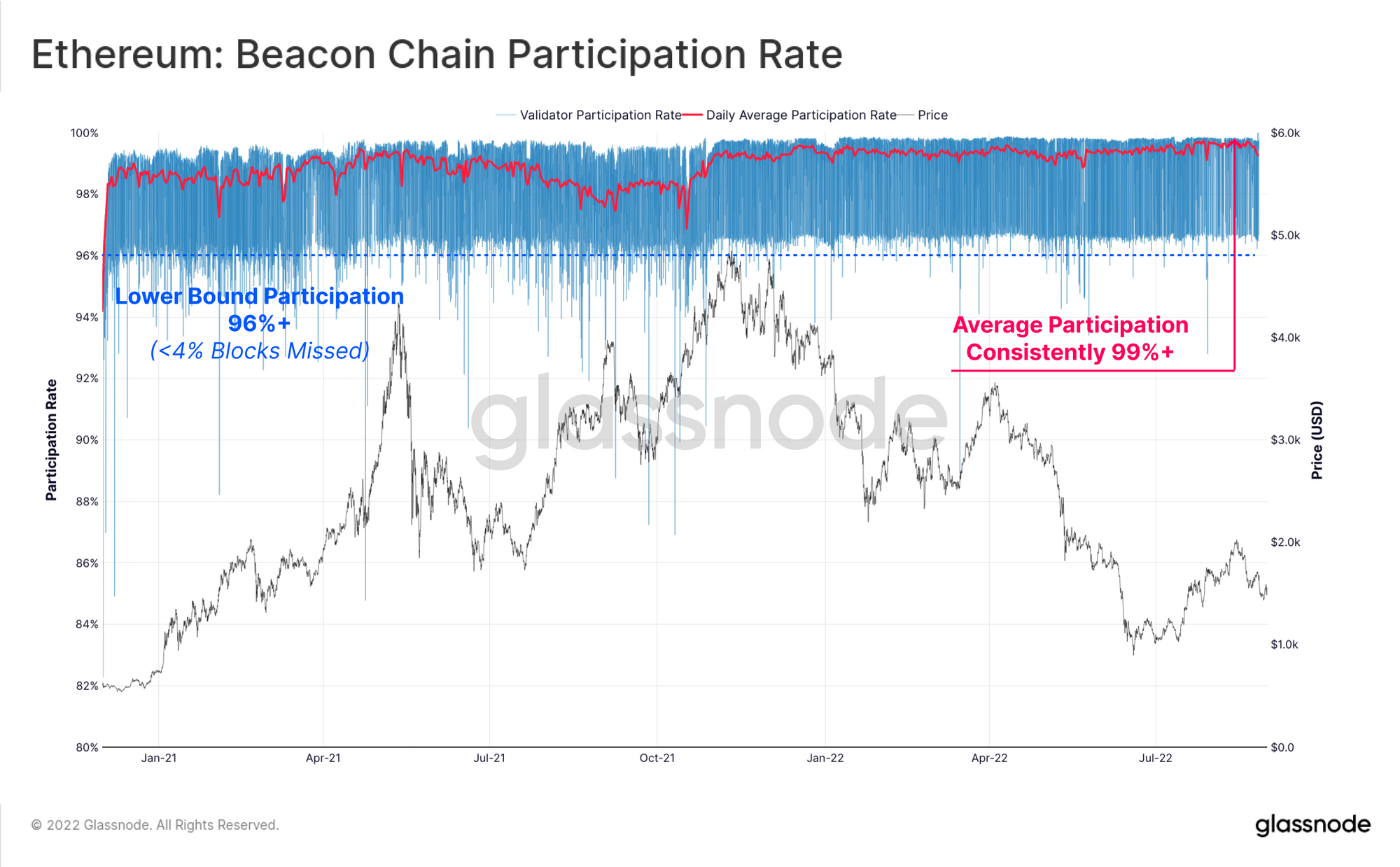

It is desirable that the blockchain maintain a high degree of reliability, which is the result of high validator node uptime, leading to very few missed blocks. We can measure the aggregate network performance using the Participation Rate metric, which is the ratio between the number of blocks successfully produced (i.e. not missed), and the total available slots.

The blue curve below shows the measured participation rate for each epoch, and can be seen to be generally higher than 96%. The red curve then shows the daily average, which has consistently hit 99%+ participation, particularly since the market price ATH in November 2021. This demonstrates that so far, validators on the Beacon Chain are consistently online and producing blocks when allocated a slot.

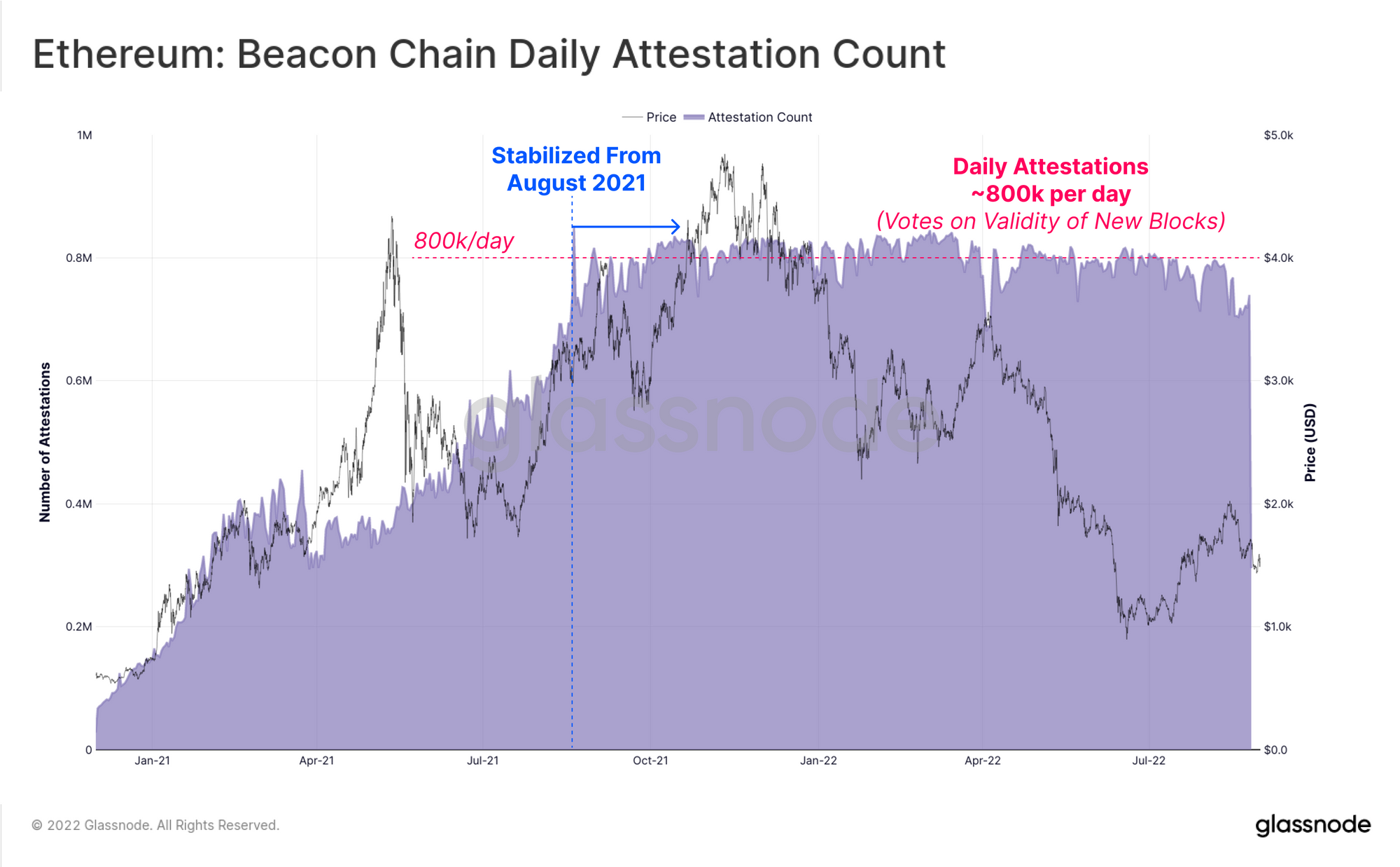

We can also measure the total number of attestation votes cast by the committee of validators who sign-off on the produced blocks. Each attestation is effectively a 'yes' vote to include the latest proposed block at the tip of the blockchain.

With an average slot interval of 12 seconds, and 127 attesting validators, we should expect a stable daily attestation count of between 783k and 914k attestations per day. Indeed, since August 2021, the total daily attestations has stabilised within this range, with around ~800k attestation votes per day.

Validators Replace Miners

In the Ethereum PoS consensus system, miners are replaced by validators, who must deposit a stake of 32 ETH in order to participate in protocol consensus. The Ethereum Beacon Chain deposit contract was launched in early November 2020, allowing early adopters to deposit ETH and help jump-start the Beacon Chain.

The first stage of the Beacon Chain roadmap was Phase 0, where a minimum threshold of 524,288 ETH was required in the deposit contract before the Genesis block could be produced. It is important to note that deposits were (and still are) one-way, with ETH unable to be withdrawn from the deposit contract until the Shanghai upgrade, which is currently anticipated to be ready 6 to 18-months after the Merge.

Whilst deposits were initially slow to start off, the Phase 0 Threshold was hit convincingly on 24-November-2020, as a rapid boost in community confidence struck a week before the planned genesis date.

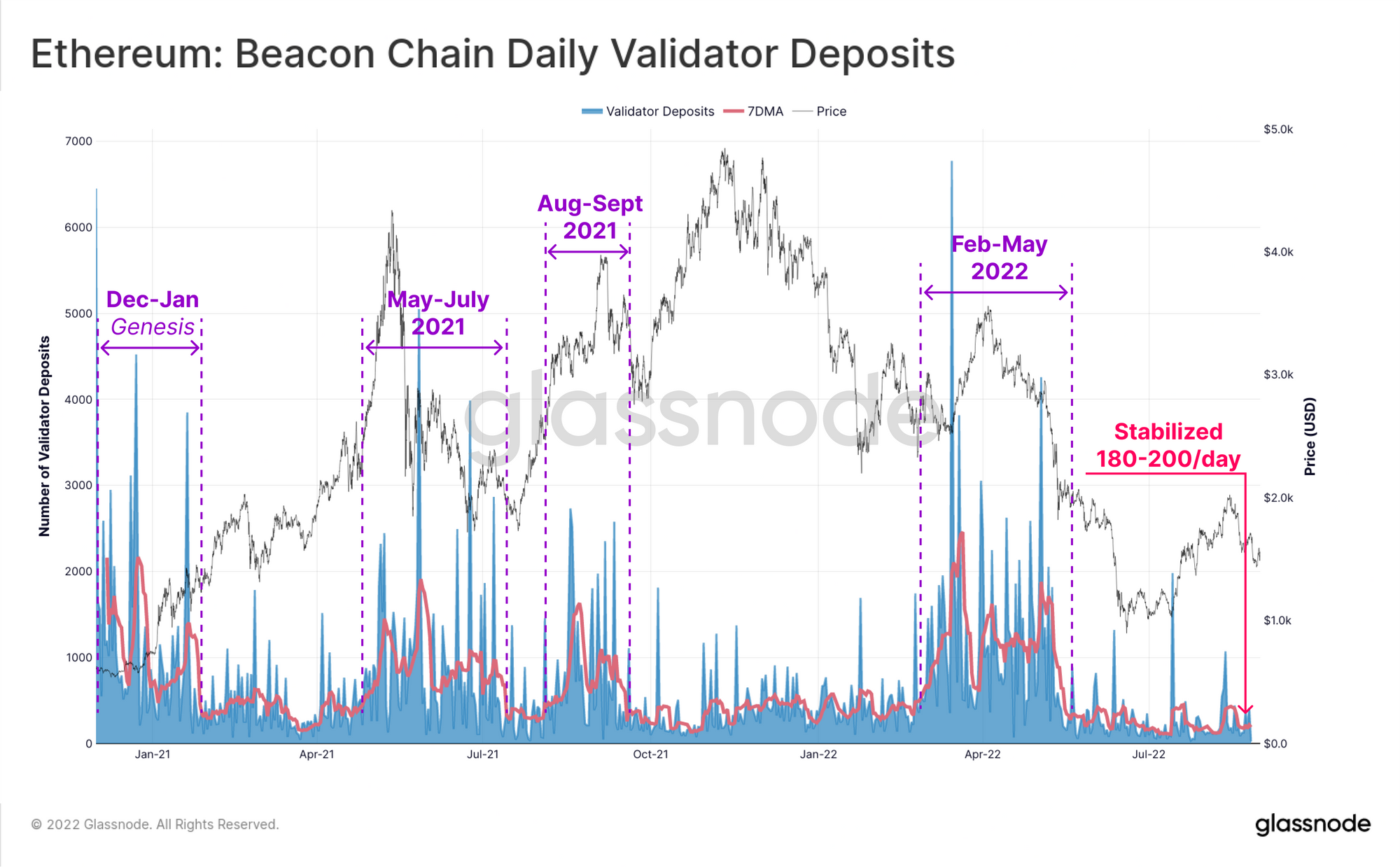

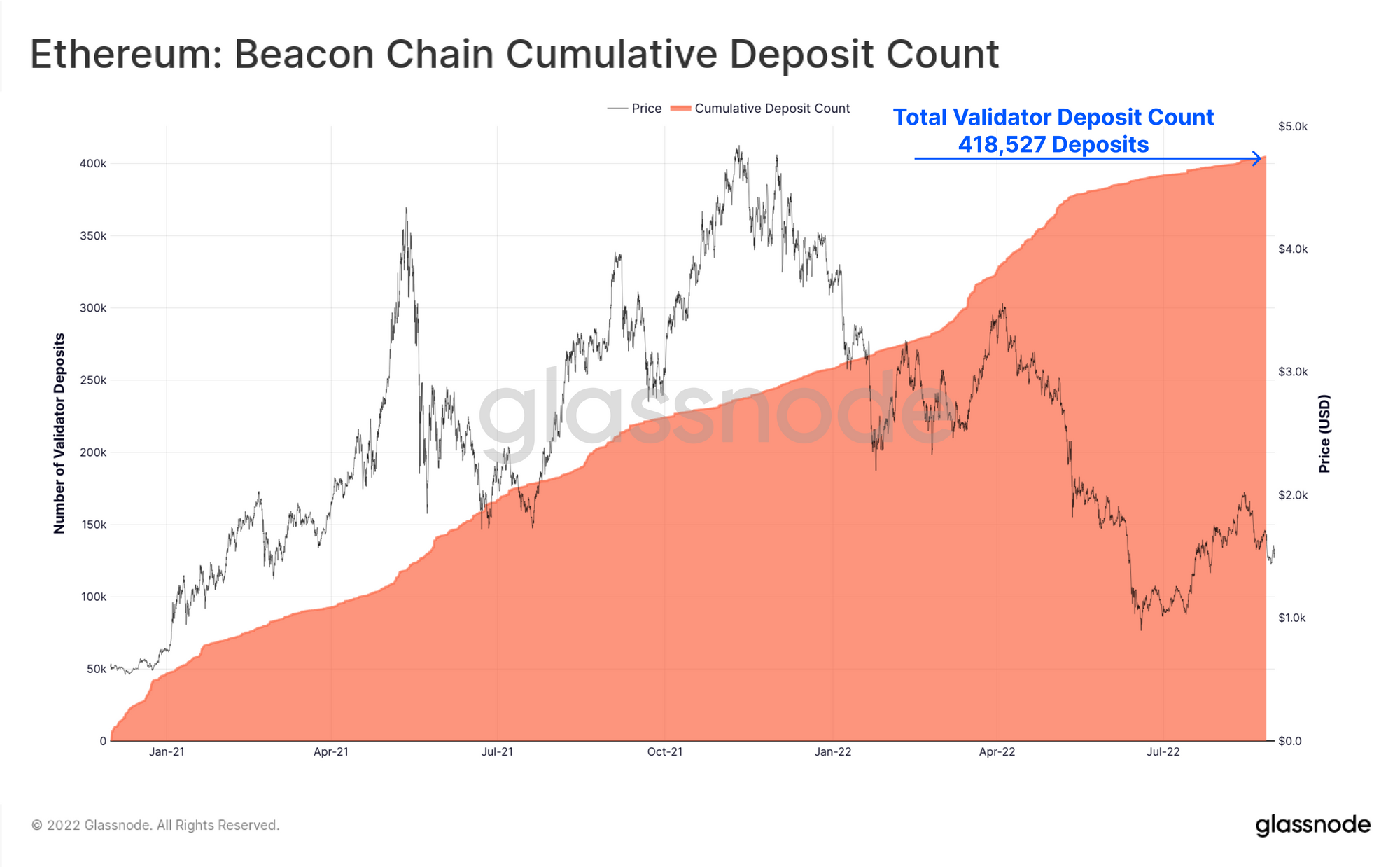

Over the last 639-days, ETH deposits have continued to flow into the Beacon Chain contract, as development progressed, staking infrastructure increased, and community confidence grew. A stable baseline of around 200 to 250 deposits per day has been observed since the genesis block.

There have been four notable periods of higher than average deposit inflows, with three during the 2020-21 bull market, and the most recent in Feb-May 2022. Deposits have slowed down following the collapse of the LUNA-UST project, which had a market-wide negative impact on token prices and confidence.

In total, investors have completed over 418,527 deposits of the 32 ETH stake required to setup a validator. Whilst this reflects the number of unique consensus level validators, it is important to note that operators of these validator nodes can custody, host, and maintain multiple validators at once, so this metric does not measure the number of unique validating entities.

Operators of liquid staking derivatives like Lido and Rocketpool, centralized exchanges like Coinbase, Binance and Kraken, and even individual solo-stakers are able to operate multiple validators at once.

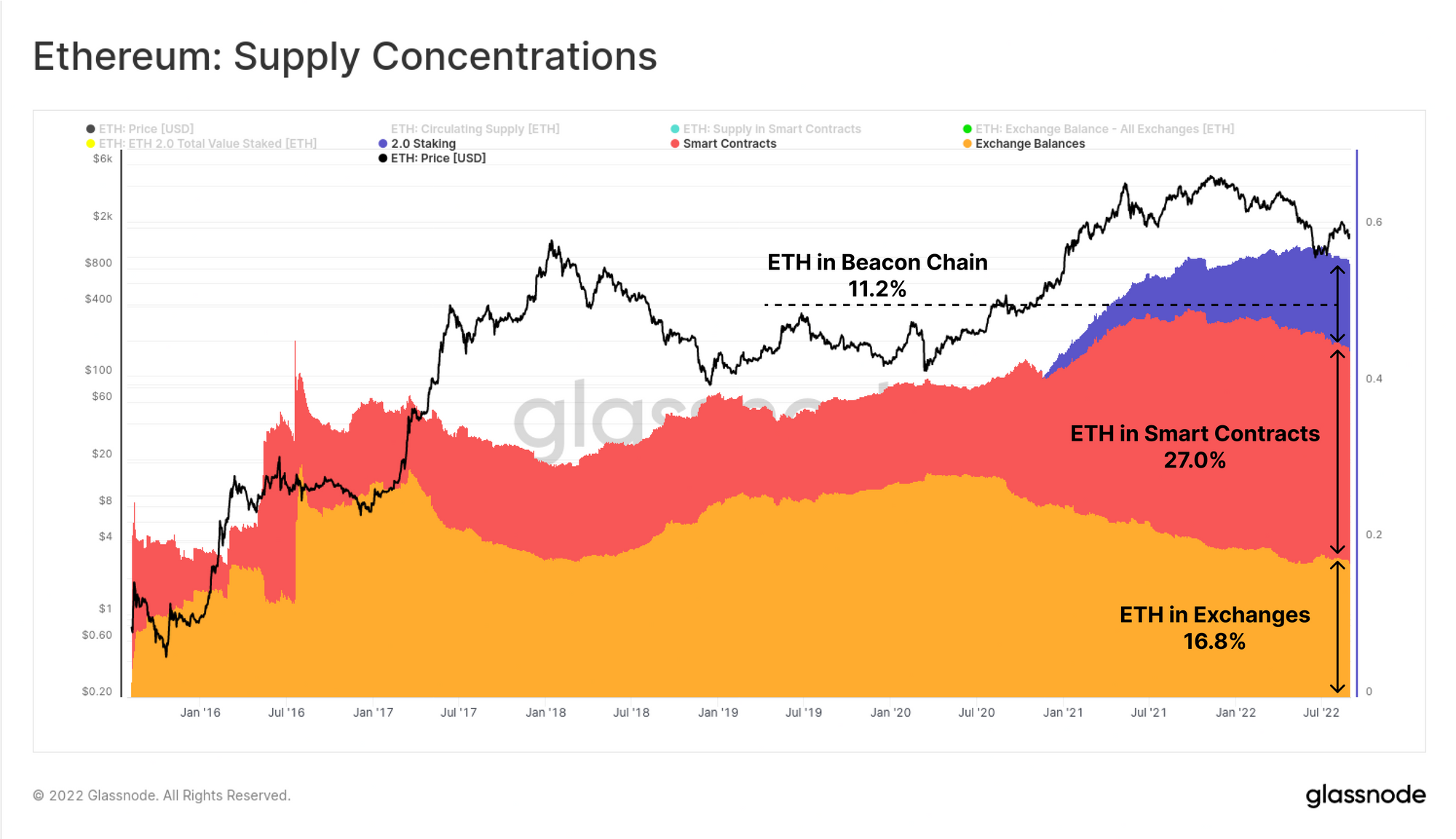

The total volume of ETH staked on the Beacon Chain has now surpassed 13.409M ETH, which is equivalent to 11.22% of the circulating supply. The Beacon Chain deposit contract is now one of the largest supply concentrations on the Ethereum network. The total Beacon Chain stake can be meaningfully compared to ETH in all smart contracts which hold 27.0% of supply, and centralised exchanges which hold 16.8% of supply.

This large volume of ETH deposited into the Beacon Chain is a signal of confidence in the success of the Merge from the Ethereum community and investors.

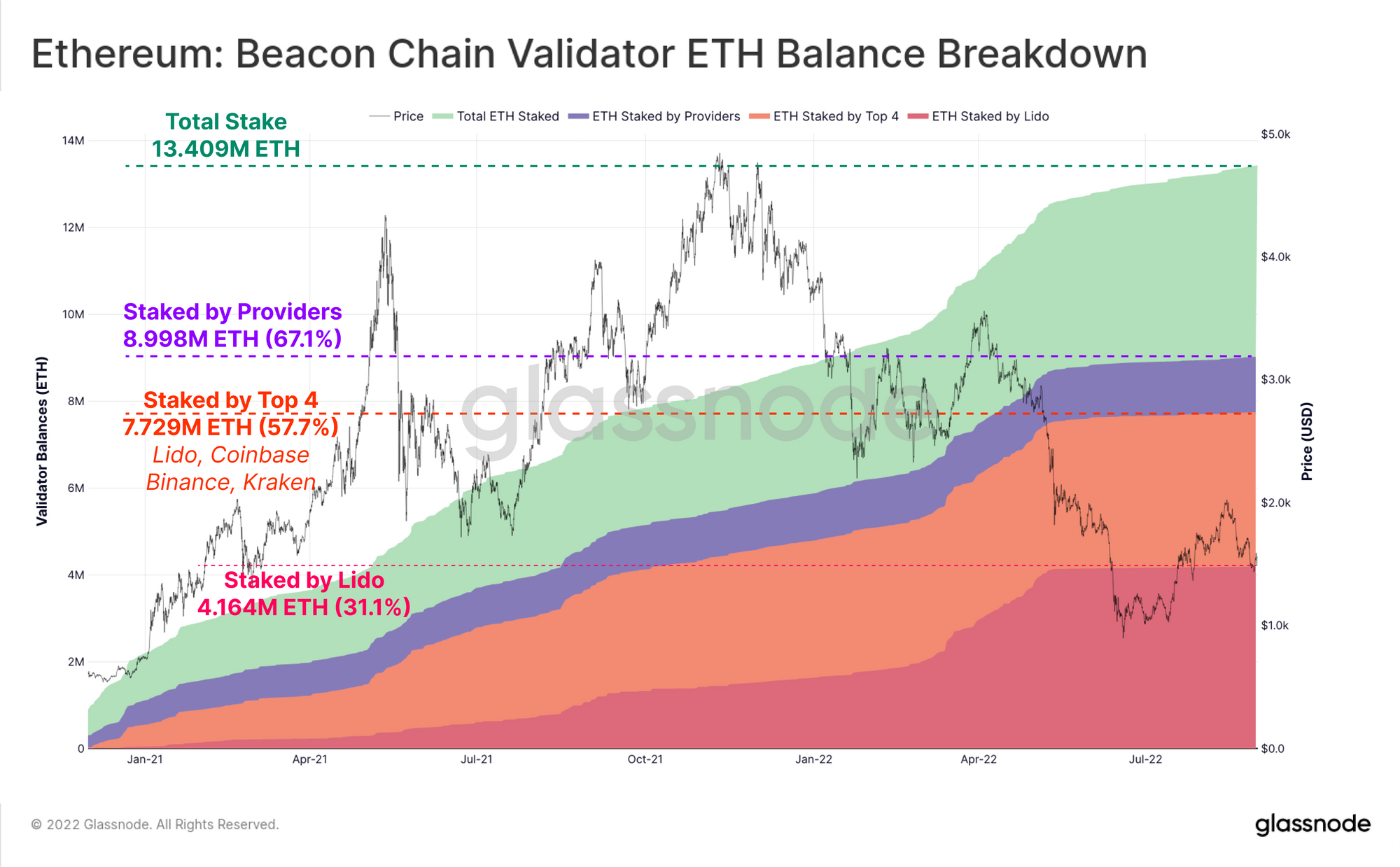

We can breakdown the various pools of staked capital to better classify the balance held by staking pools, exchange operators, and other unknown or solo stakers.

- Lido (red) is the largest entity in the staking network, operating validators which account for over 4.164M ETH, and represent 31.1% of the validator pool.

- Top 3 Exchanges (orange) include Coinbase, Kraken, and Binance, which have a combined stake of 3.565M ETH, and account for 26.6% of the validator pool.

- All Other Stake Providers (purple) account for an additional 1.269M ETH and 9.5% of the validator pool. If we combine all of these aforementioned staking pool operators, they represent a stake of 8.998M ETH, and operate 67.1% of the validator pool.

- Solo-Stakers and Unknown (green) host the remaining 4.411M ETH, accounting for just under a third of the validator pool (32.9%).

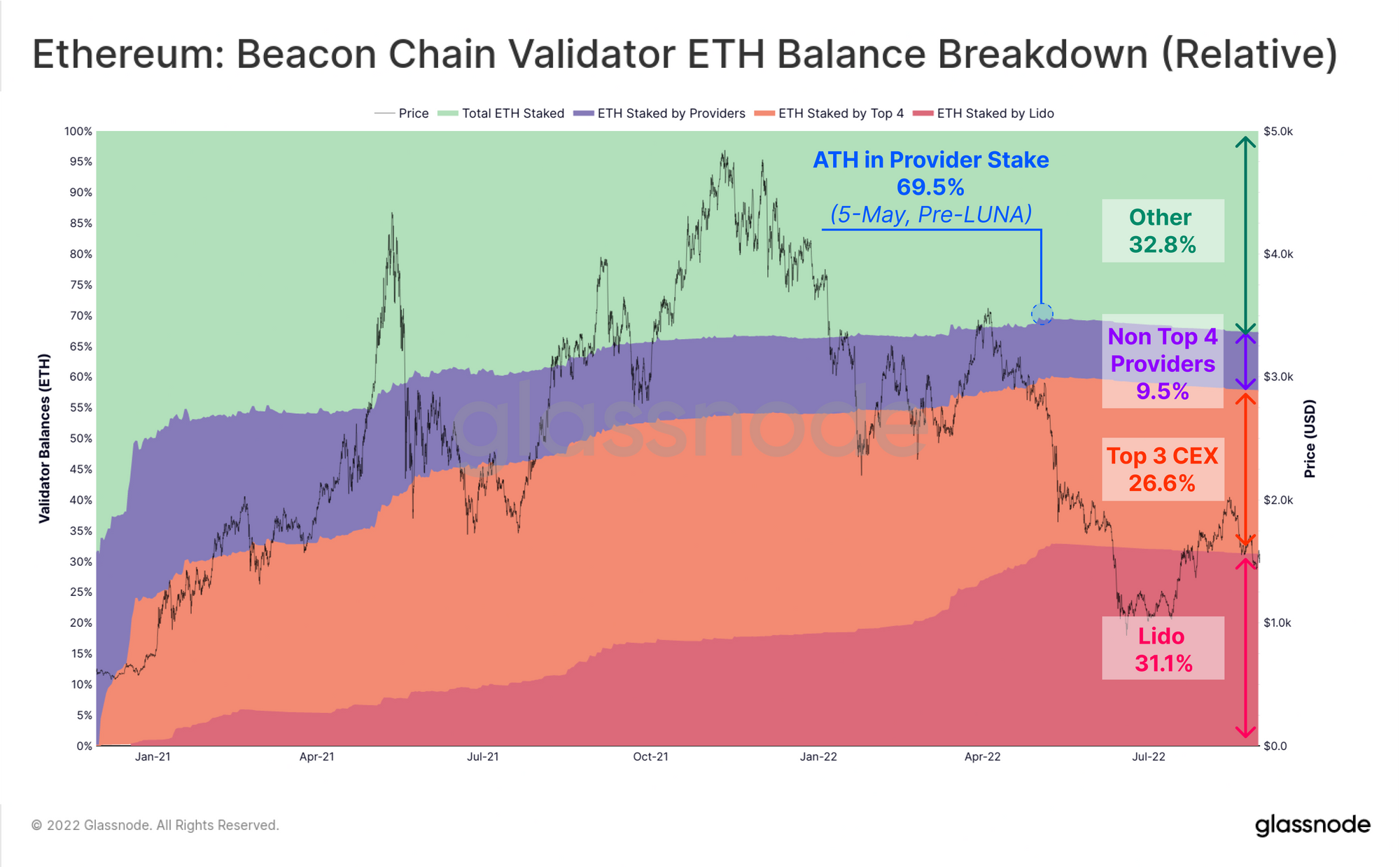

The chart below presents this breakdown in relative terms, where we can see that staking providers quickly became quite dominant in the validator pool, with Lido seeing the most remarkable growth. This is likely the result of a combination of factors, including but not limited to:

- Technical overhead required to operate a solo-staking validator.

- Convenience and risk delegation to professional staking services.

- Investors with less than the required 32-ETH pooling their stake.

- Ability to tokenise and then trade, or use as collateral in DeFi with staking derivatives such as Lido, Rocketpool, and more recently Coinbase with the cbETH product.

Interestingly, the 'Solo Staker and Unknown' cohort (green) have increased their dominance slightly, seemingly following the collapse of LUNA-UST. Staking provider dominance peaked at 69.5%, and has since declined to 67.2%.

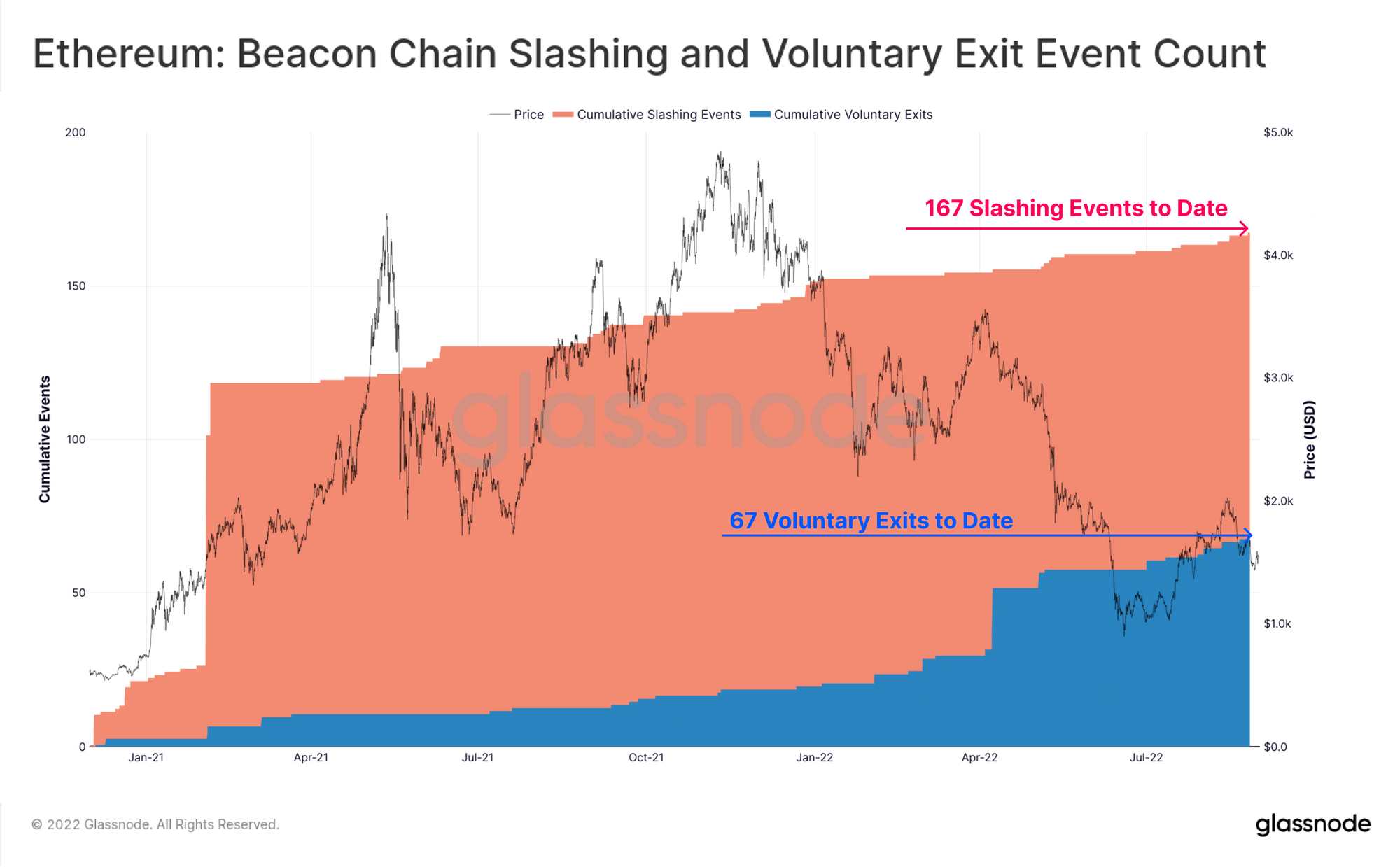

Whilst the Beacon Chain deposit contract is a one-way street at the moment, validations can still be removed from the staking pool via two mechanisms:

- Voluntary Exit (blue) where a validator opts to cease participating in consensus, and enters the exit queue. These validator no longer propose or attest to blocks, but the ETH stake cannot yet be withdrawn.

- Slashing in the event of malicious behaviour where the protocol forcibly ejects a validator from the pool for misbehaviour such as proposing, or attesting to invalid blocks, or non-consensus chainsplits.

To date, only 67 validators have voluntarily left the pool, and 167 slashing events have taken place. Further investigation is required to assess whether these were cases of engineering testing during the development process, or genuine malicious events.

Validator Performance and Revenue

Validators must initially deposit a stake of 32 ETH to start a validator, and will be ejected from the protocol if their balance falls below 16 ETH (in the event of inactivity leak or slashing). Once a validator has entered the protocol, their total ETH balance will begin to change due to a number of factors:

- Revenue earned from issuance and fees (balance increase)

- Inactivity leak if validators often miss blocks or attestations (balance decreases).

- Slashing in the event of malicious behaviour (balance decreases).

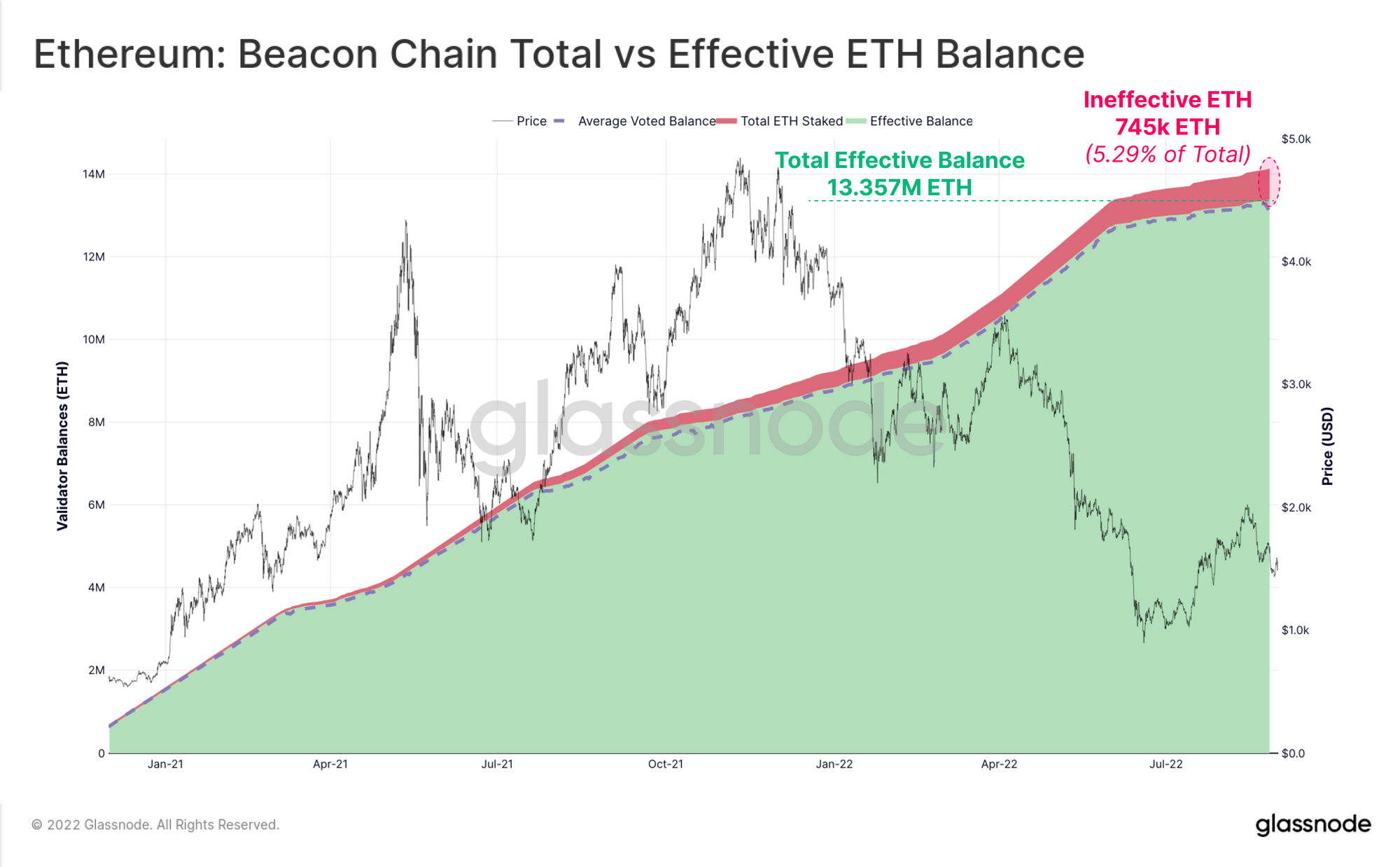

There is also a concept called Effective Balance, which is capped at 32 ETH on the upside, and decreases to the nearest 1 ETH increment below this (with a minimum buffer of 0.25 ETH). For example:

- If a staker has 32 ETH and earns 0.5 ETH in rewards, their Total Balance (red) is 32.5 ETH, but their Effective Balance (green) is still 32 ETH.

- If a staker has 32 ETH but leaks 0.5 ETH in inactivity penalty, their Total Balance (red) is now 31.5 ETH, but their Effective Balance (green) is rounded down to 31 ETH.

- A Total Balance of 31.250 ETH will have a Effective Balance of 31 ETH

- A Total Balance of 31.249 ETH will have a Effective Balance of 30 ETH

The chart below shows the aggregate Effective Balance (green) which is actively participating in PoS consensus. The remaining Total Balance (red) is essentially excess ETH which may be considered a buffer of inactive stake. At the moment, the total effective balance is 13.357M ETH, and around 745k ETH is inactive (5.29% of total).

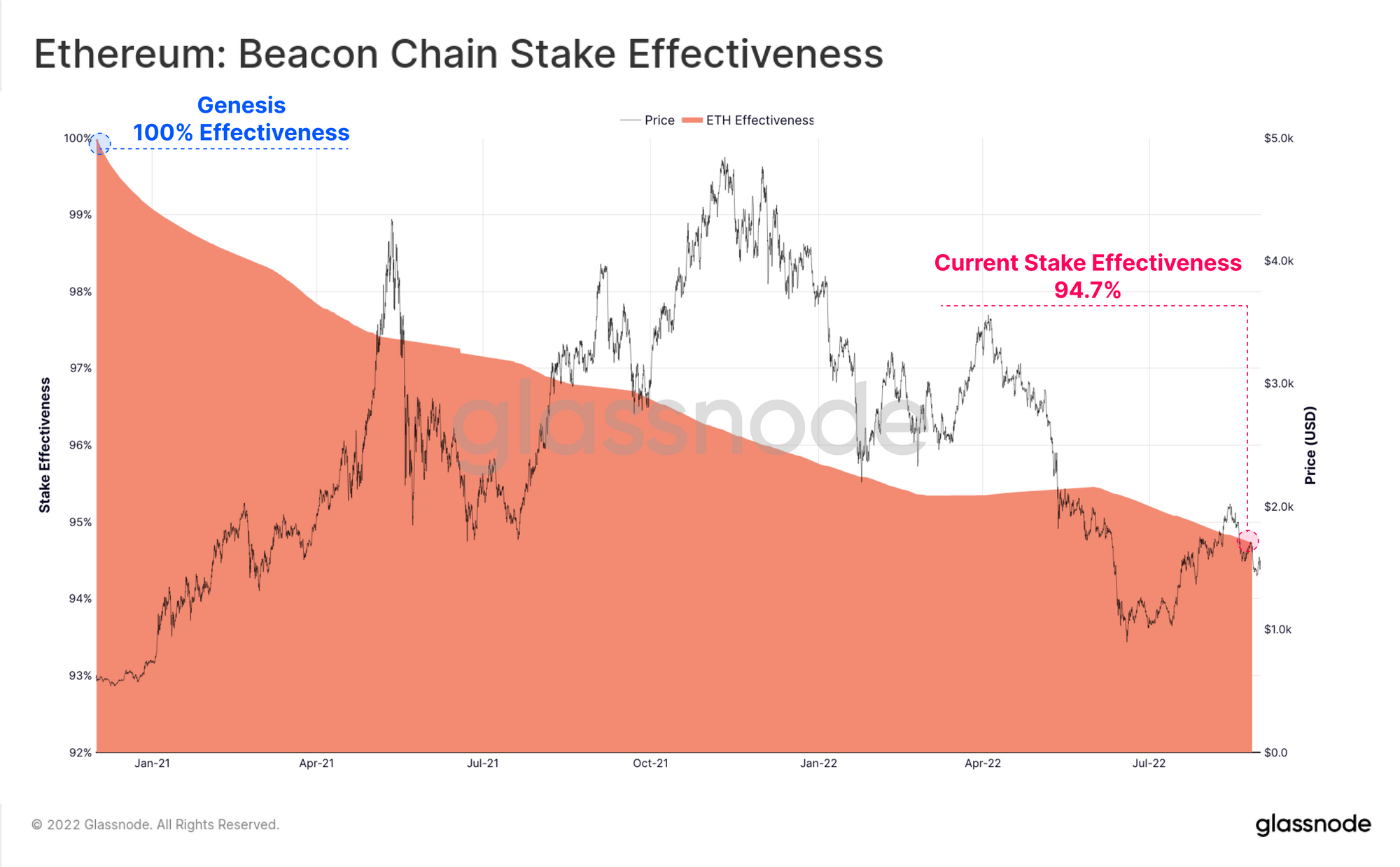

We can then calculate a new metric called Stake Effectiveness which captures this balance in a ratio between Effective and Total staked ETH. With 5.29% of staked ETH currently inactive, the Stake Effectiveness has declined from 100% at genesis, to 94.7% at the moment. This will be largely due to revenue earned by validators pushing the average validators total balance above 32 ETH.

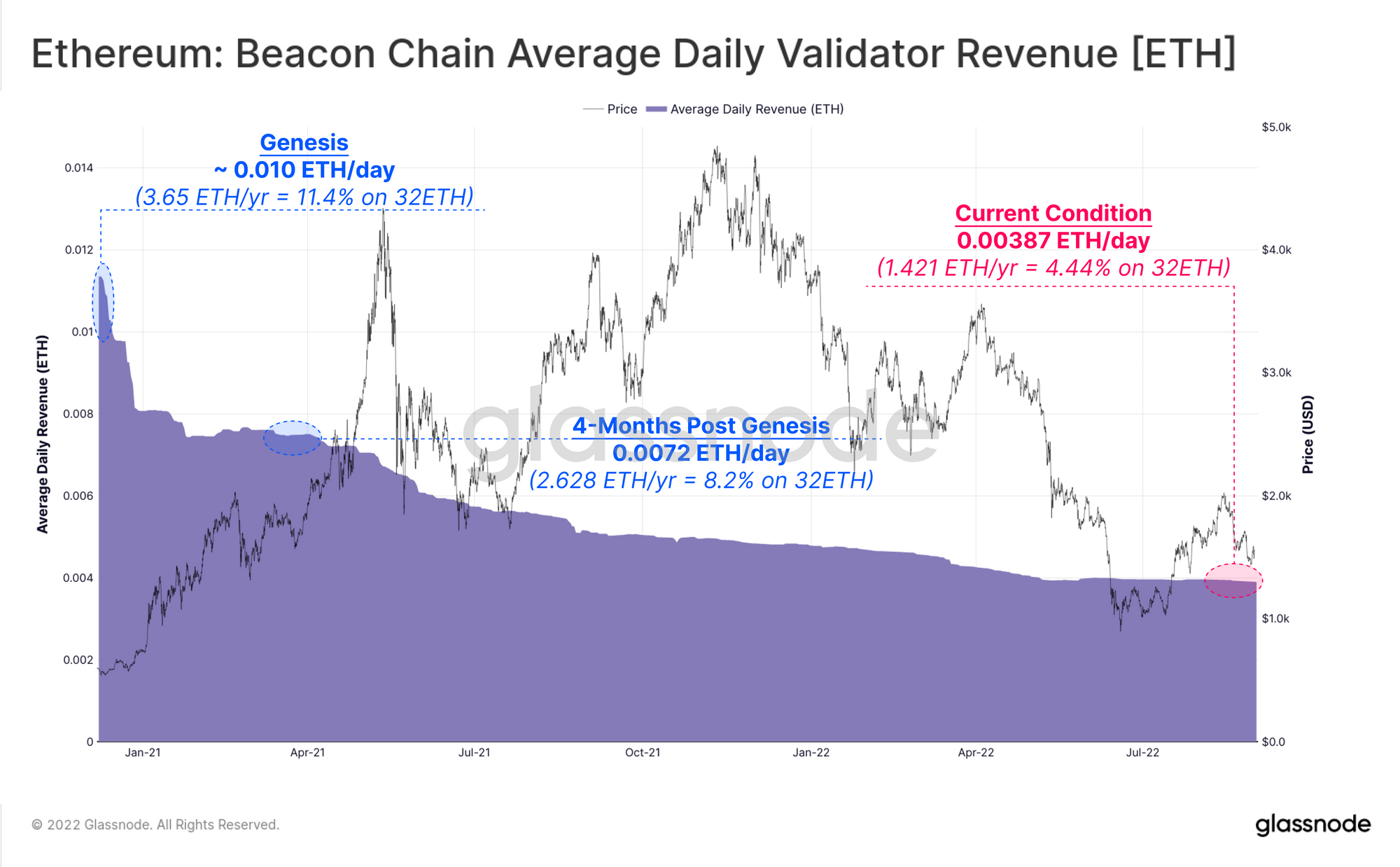

We can also investigate the revenue earned by the aggregate validator pool so far. In Ethereum PoS consensus, the issuance rate is in part dependant on the amount of ETH staked such that as the more people are staking, the lower the per validator reward.

This has played out so far, with the annualized average ETH revenue declining from 3.65 ETH/yr at genesis, to 1.42 ETH/yr today. Considering the deposit contract is essentially one way (and very few validators have left the pool), this reward dilution is almost entirely a result of the increasing volume of staked ETH over the last 18-months.

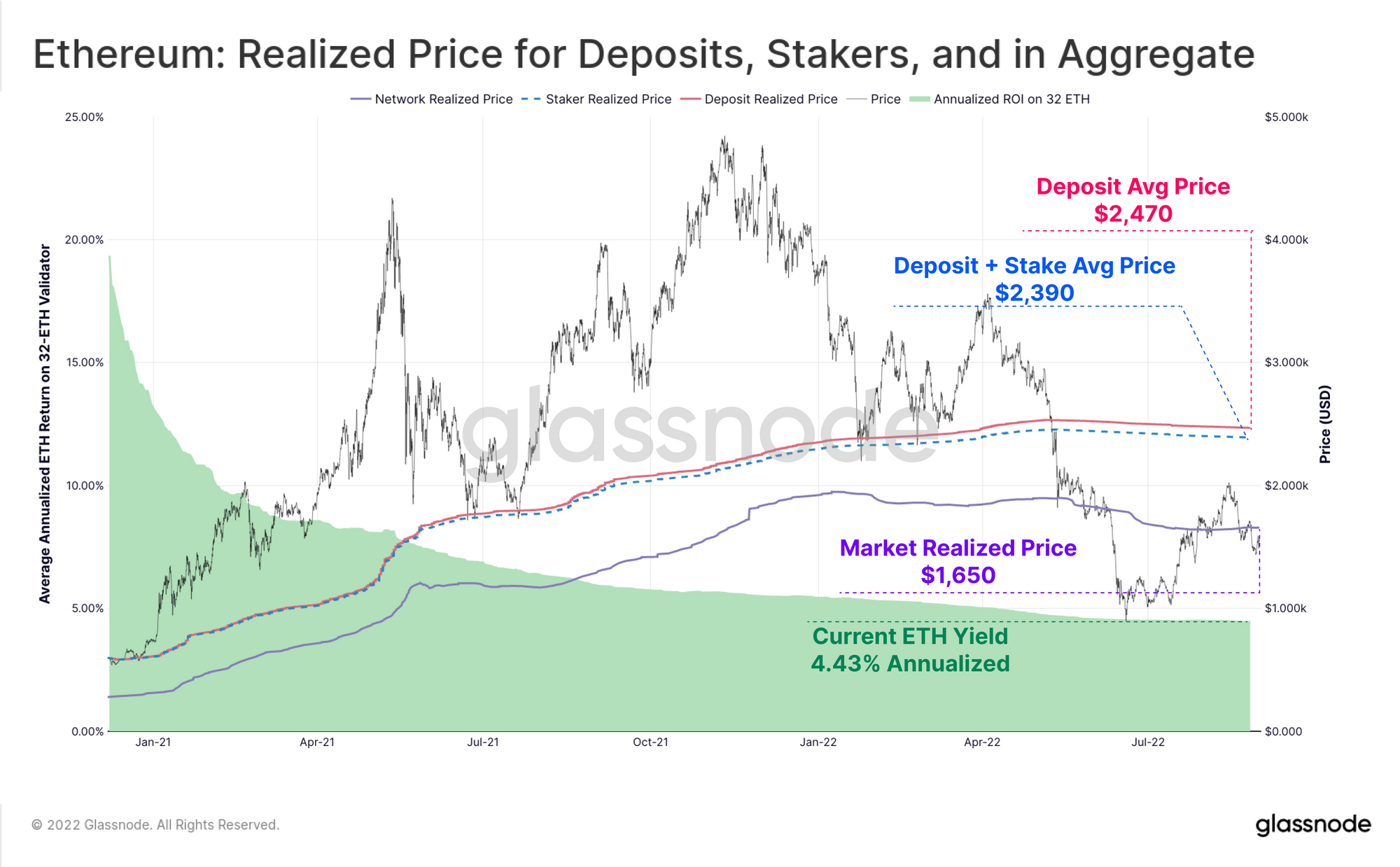

The annualized ETH denominated yield on a 32 ETH deposit has declined accordingly, dropping from over 15% at genesis, to just 4.44% today. Post Merge, it is likely that investors will find comfort in the successful upgrade, and additional deposits will drive this yield even lower still.

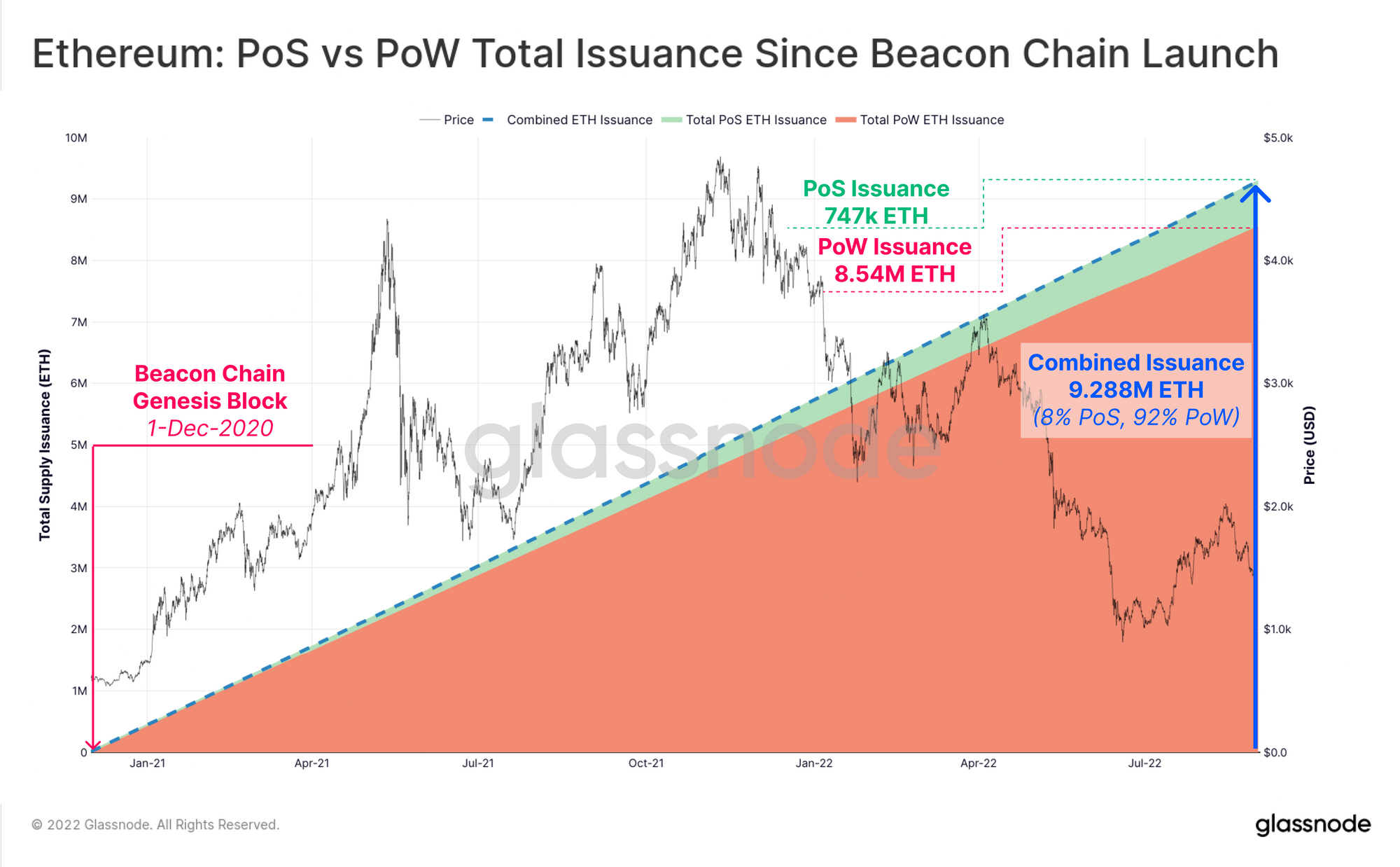

With both the PoS Beacon Chain, and the existing PoW Etheruem chains operational, the total issuance of ETH currently has two sources. Since the Beacon Chain genesis block, a total of 747k ETH has been issued on the PoS chain, and 8.54M ETH on the PoW chain. This equates to an issuance split of approximately 8% PoS vs 92% PoW.

This also demonstrates how the PoS chain is currently operating with significantly lower issuance relative to the PoW chain.

We can also perform an assessment of the Realized Price of Beacon Chain deposits, and the impact staking rewards have had on lowering the average cost basis. The Realized Price is calculated by multiplying the deposited ETH by the spot price at the time, and then taking an average across the total staked ETH. This provides an estimate of the 'average deposit price' for the validator pool.

- Ethereum Realized Price for the entire market (purple) is $1,650, reflecting the average price at which the circulating ETH supply last transacted.

- Realized Price for all Beacon Chain deposits (red) is $2,470, which is 50% higher than the average for the market. This means that staked coins are holding an unrealized loss which is 33% larger than the average ETH investor.

- Realized Price for Beacon Chain including staking rewards (blue dash) is $2,390, which represents a 3.2% average benefit to the cost basis of stakers, but remains well above the average market participant.

This demonstrates that despite stakers earning an additional 3.2% in ETH denominated yield on average, the 2022 bear market has resulted in the average deposit being significantly underwater relative to their deposit price. This also highlights why liquid staking derivatives like Lido gained such a significant share of the staking market.

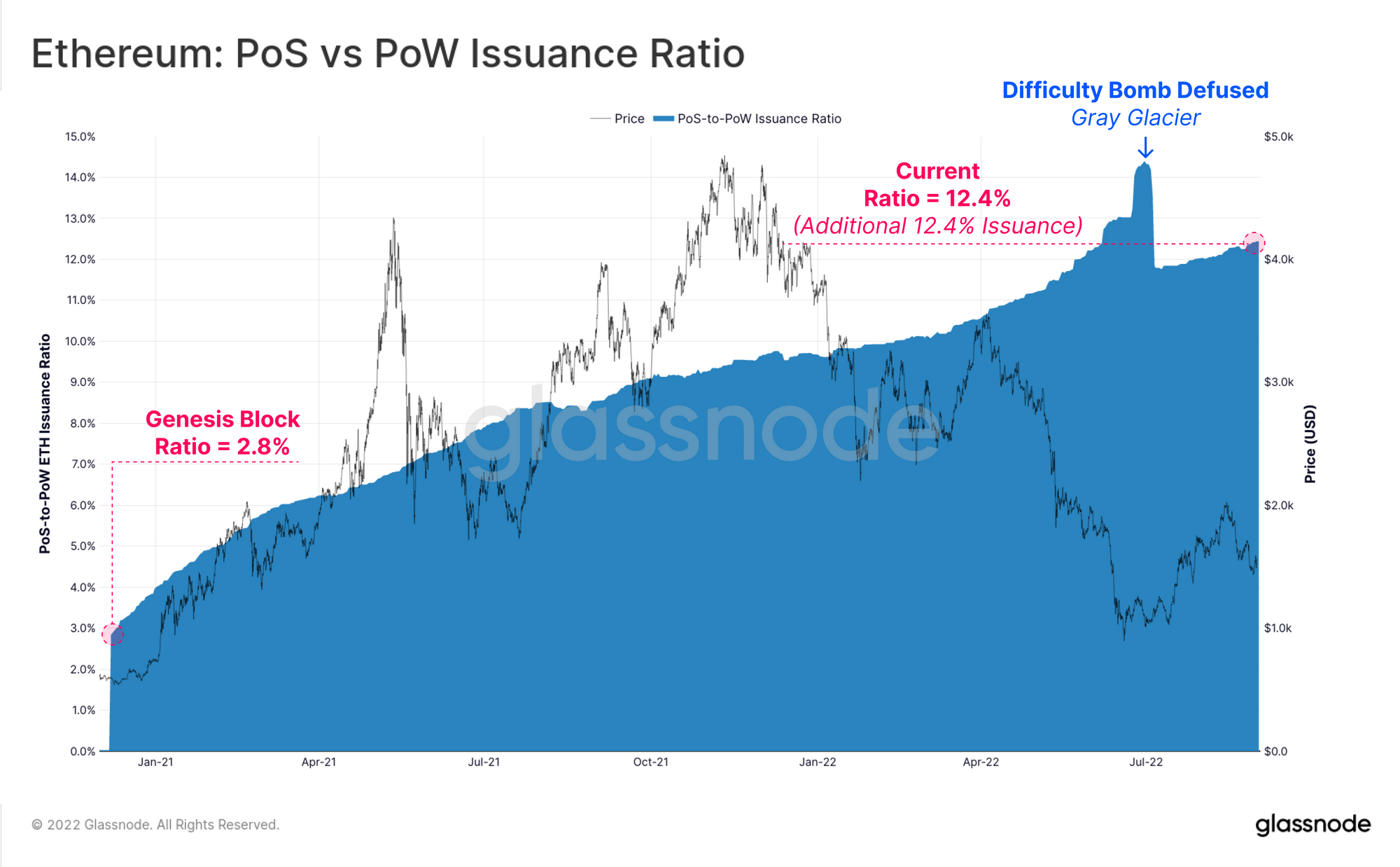

Whilst issuance on the PoW chain has remained relatively stable at around 2 ETH per block (plus ~0.05 to 0.10 ETH in uncle rewards), issuance on the PoS chain has steadily increased as more validators entered the pool. Total daily PoS issuance has increased from around 340 ETH/day, to 1,623 ETH/day at present.

If we take a ratio between the daily ETH issuance via PoS and PoW, we can see that the proportion of ETH issuance attributed to the Beacon Chain has steadily risen. The PoS chain has effectively increased net ETH issuance by 2.8% at genesis, to over 12.4% today.

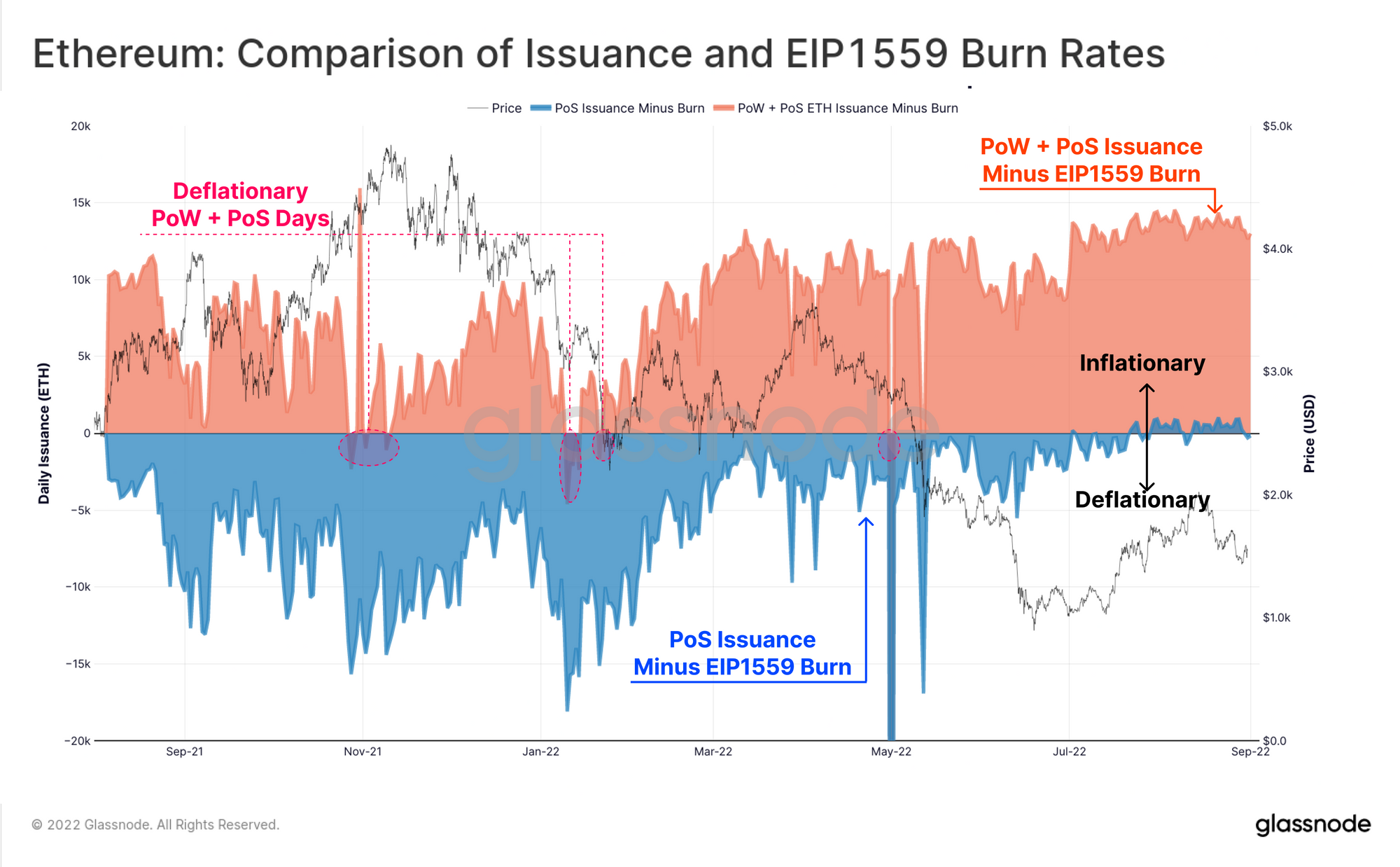

Finally, we will seek to address one of the biggest post-Merge questions; what will the estimated impact on net ETH supply be with the combined reduction in PoS issuance, and the EIP1559 burn mechanism? The chart below presents two curves of daily ETH issuance since EIP1559 went live in August 2021:

- Current condition (orange), with ETH issuance occurring on both the PoW and PoS chains, with the EIP1559 burn active on the PoW side. Aside from a handful of days, the ETH supply has been net inflationary, oscillating between around 11.8k and 14.3k ETH issued per day since July.

- Simulated condition (blue), with only the PoS Beacon Chain active, and with EIP1559 live on the PoS chain. This simulates what the market may have been like if the Merge was shipped with EIP1559, and it shows a clear net deflationary system until late-July 2022 where issuance stabilises around +500 to +1,000 ETH/day.

Given on-chain demand, and thus gas prices are very soft at present, this highlights that with any meaningful pickup in gas fee pressure, ETH can be reasonably expected to become a net deflationary supply asset.

Summary and Conclusions

The Ethereum Merge is fast approaching, and is the culmination of many years of hard work, and remarkable engineering and research efforts. With all Ethereum test-nets now having successfully completed the Merge over recent months, the main-net Merge has been formally scheduled, and is estimated on 15-September-2022.

In this report we explored the fundamental mechanics of Ethereum's new Proof-of-Stake consensus mechanism, and how we can study the network performance of the Beacon Chain. We assessed the performance of the Beacon Chain to date, and profiled validator deposits, revenue streams, and possible implications on the net ETH supply dynamics.

With over 11.2% of the ETH circulating supply now participating in PoS consensus, it represents a significant vote of confidence from the Ethereum community. We can look forward to a successful main-net Merge, and to analysing the new and fascinating Proof-of-Stake consensus mechanism into the future.

- Follow us and reach out on Twitter

- Join our Telegram channel

- Visit Glassnode Forum for long-form discussions and analysis.

- For on-chain metrics and activity graphs, visit Glassnode Studio

- For automated alerts on core on-chain metrics and activity on exchanges, visit our Glassnode Alerts Twitter